1

Selected Terms and

Conditions for WellsFargo Consumer

Debitand ATM Cards

Terms and Conditions eective 7/23/2024.

Introduction page 1

Using Your Card page 2

Using Your Card Through a Mobile Device page 4

Understanding Authorization Holds for Card

page 5

Transactions

Creating an Overdraft Using Your Card page 5

Handling Preauthorized Payments page 5

Other Considerations page 6

Card on File with Merchants page 6

Helping Protect Your Card page 6

Card and ATM Safety Tips page 7

Contact Us page 7

INTRODU

CTION

This brochure describes your rights and responsibilities for your

debit or ATM Card, and adds information to our

• Deposit Account Agreement,

• Consumer Account Fee and Information Schedule,

• Other Account Agreements,

• Any additional disclosures, amendments, or addenda we

provide to you, and

• Any updated information we gave you since you opened your

Account.

However, if this brochure diers from the documents listed

above, the information in this brochure will control, unless

otherwise stated. If you have other accounts that you wish to

access using your Card, the agreements applicable to those

accounts will control when your Card is used to access those

accounts.

Para obtener una copia de estos Términos y Condiciones en

español, visite wellsfargo.com/terminostarjetadebito .

Dening words in this brochure

• “Account” refers to the checking and/or savings account(s)

accessible using your Card.

• “Busi

ness day” is any day except Saturday, Sunday, and federal

holidays.

• “Card” includes every type of consumer, Premier or Private

Bank debit Card and consumer ATM Card that we may issue to

you.

• “Mobile Device” means a smartphone, tablet, computer or

any hand held or wearable communication device and any

third-party application within a device that allows you to

electronically store or electronically present your debit Card or

debit

Card number, which is replaced with a unique “Digital Card

Number,” to make debit Card transactions.

• “Overdraft” is an available balance of less than $0.00 in your

Account.

• “PIN” refers to your personal identication number.

• “We,” “us,” “our,” and “Bank” refer to Wells Fargo Bank, N.A.

• “You” and “your” refer to the owner and, if applicable, each

co-owner of an Account.

Unless otherwise specied, a “day” is dened as the 24-hour

period from midnight to midnight, Pacic Time. Transactions

made in other time zones will be based on when received in

Pacic Time.

Disclosing your information

Generally, we will not disclose information about your Account,

but we may do so in the following situations:

• To comply with a statute, regulation, or rule.

• In any legal process, including subpoena, search warrant, or

other order of a government agency or court.

• In connection with examinations by state and federal banking

authorities.

• If we

need to disclose information to complete a transaction.

• To ver

ify the existence and condition of your Account for a third

party, such as a merchant or credit bureau.

• To provide information to the legal representative or successor

of a deceased co-owner for the period during which the

deceased had an interest in your Account.

• To report the involuntary closure of your Account.

• When disclosure is necessary to protect you, your Account, or

our interests.

• If you give us your permission.

• To our agents, independent contractors, and other

representatives who service or process your Account

transactions, Account analysis, or for similar purposes.

• To our aliated banks and companies and to unaliated third

parties in accordance with our Privacy Notice.

2

Ac

tions

Debit

Card

ATM

Card

-

USING YOUR CARD

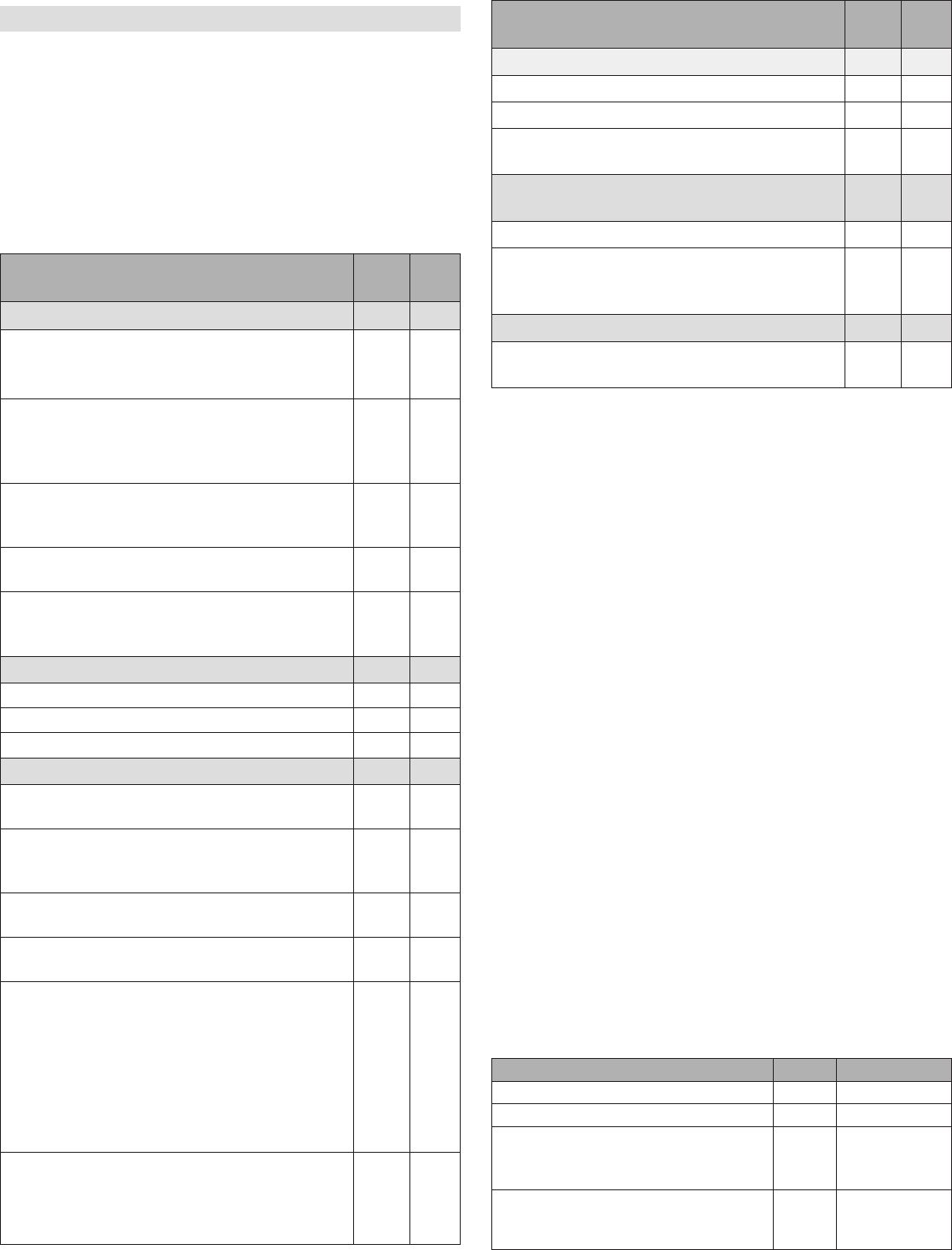

Table 1 shows how you can use your Card to make purchases and

payments, make transfers, and use ATMs and other services. You

authorize us to act on your instructions that we receive through

any ATM, merchant or network in which we participate. Note:

Some services described below may not be available at all ATMs

or merchants.

Using your Card can include using your physical Card or accessing

your Card by using it through a Mobile Device as noted in the

following chart.

TABLE 1

Actions

Debit

Card

ATM

Card

To purchase or pay

At merchants who

accept payments

through a network in which we participate

(e.g., Visa® and MasterCard®)

3

3

1

Pay bills directly to m

erchants or other

providers with you

r Card, or through a

Mobile Device at merchants who accept

mobile payments

3

Request cash

back when making a purchase

with your PIN at merchants whooer this

service

3

3

Through a Mobile Device

at merchants who

accept mobile payments

3

Choose whether

and how you receive a

receipt at the time you use your Card at

amerchant terminal

3

3

At all Wells Fargo ATMs

View your Account balan

ces

3

3

Withdraw cash

3

3

Transfer funds between your Accounts

3

3

At most Wells Fa

rgo ATMs

2

Make deposits

to your Accounts (up to any

deposit limits that may apply)

3

3

Transfer funds from your eligible

WellsFargo credit accounts to your

Accounts

3

3

3

Make payments

to your eligible WellsFargo

credit accounts

3

3

Get a statement of your account bal

ances

or last 10 transactions

4

3

3

Choose how you want to receive your ATM

receipt: printed, emailed to the address on

le or to your Wells Fargo Online® secure

inbox, or texted to your mobile phone

number on le (availability may be aected

by your mobile carrier’s coverage area, and

your mobile carrier’s message and data

rates may apply)

3

3

Use your Mobile Device to access Wells Fargo

ATMs by tapping it near the Contactless

Symbol (see “Using Your Card Through a

Mobile Device” for more details)

3

At non-Wells Fargo ATMs

5

View your Account balance (fees may apply)

3

3

Withdraw cash

(fees may apply)

3

3

Transfer funds between your Accounts

(fees may apply)

3 3

At other locations to withdraw money using

your physical Card

Wells Fargo bank locations (fees may apply)

3

3

Non-Wells Fargo banks that

accept Visa

branded cards when a teller helps you with

your transaction (fees may apply)

3

3

Via electronic credit transfers

Receive transfers, such as t

hose through

card networks or funds transfer systems

6

3

1 .

Pu

rc

ha

se

s made using an ATM Card are only available at merchants who

accept payment through networks in which we participate and require a PIN

to authorize the purchase.

2 . While most Wells Fargo ATMs oer these additional features and services,

some Wells Fargo ATMs are limited to cash withdrawals, balance inquiries,

and fund transfers between accounts linked to your Card as primary

checking and primary savings. The features and services oered at a

particular WellsFargo ATM will be displayed on the ATM screen.

3 . Cash advance and ATM advance fees may apply. Refer to the applicable credit

card account agreement or line of credit account agreement for more details.

4 . Statements at ATMs should not be used in place of your Account statement

for balancing or verifying the actual Account balance.

5 . Non-Wells Fargo ATMs are ATMs that are not owned or operated by

WellsFargo or are not prominently branded with the Wells Fargo name and

logo. You can use your Card at non- Wells Fargo ATMs that display the Plus®

logo to withdraw cash, check balances, and transfer funds between the

Accounts linked to your Card as primary checking and primary savings. Note:

1) Some non-Wells Fargo ATMs may not give you the option of choosing

which Account to access or may only let you access one of your Accounts. 2)

Some transactions may not be available at all ATMs, may be dierent from

those available at Wells Fargo ATMs, or may be limited to any withdrawal

limit(s) set by the non-Wells Fargo ATM.

6 . If your debit Card or debit Card number is used to receive a credit transfer,

the frequency and dollar amount of those transfers may be limited by the

applicable card network.

Fees we charge for using you

r Card

Table 2 shows fees we may assess. These fees may not be

applicable to all customers. Your Account may provide fee

waivers on certain fees listed below. For more details, refer to the

applicable Wells Fargo Fee and Information Schedule for your

Account.

TABLE 2

U.S.

7

International

Non-WellsFargo ATM fees

Cash withdrawal transaction

$3 $5

Non-Wells Fargo bank cash

disbursement fees for using a debit

Card to withdraw cash from ateller

$3

3% of

transaction

amount

International pu

rchase

transaction fee

8

3% of

transaction

amount

3

7. U.S. includes the 50 states and the District of Columbia, as well as th

e U.S.

territories of American Samoa, Guam, Northern Mariana Islands, Puerto Rico,

U.S. Minor Outlying Islands, and U.S. Virgin Islands.

8 . For each debit Card purchase in a foreign currency that a network converts into

a U.S. dollar amount.

Fees non-Well

s Fargo ATM operators may charge

The non-Wells

Fargo ATM operator or network may charge you

a fee. Their

fee is included in the total amount withdrawn from

your Account

and will apply to your Card’s daily ATM withdrawal

limit. We m

ay reimburse that fee, in whole or in part, if allowed by

the terms

of your Account.

Merchant and

third party fees

Some mercha

nts may assess a fee when you use your Card for

a purchase

or for cash back. This fee will be included in the total

purchase am

ount and will apply to your Card’s daily purchase

limit. You

may also be charged a fee by other banks and nancial

institutio

ns for cash disbursements at their branches. That fee

may be add

ed to your total disbursement and will apply to your

Card’s daily

ATM withdrawal limit.

ATM and merch

ant terminal malfunctions

We are not re

sponsible for damages resulting from an ATM

or merchant terminal malfunction, except to the extent that

malfunction results in an error (see page 6 for Regulation E

provisions).

WellsFargo ATMs in Assisted-Service mode

Some WellsFargo ATMs in branches can operate in “Assisted-

Service mode” during branch hours. When in Assisted-Service

mode, the ATM screen’s main menu will display an “I need

assistance” option. Note: When using a Wells Fargo ATM in

Assisted-Service mode, your Card’s daily ATM withdrawal limit

may not apply, and you may be able to access and perform

transactions on some of your consumer deposit accounts that

are not linked to your Card.

Note: If you are accessing a Wells Fargo ATM in Assisted-Service

mode using a Mobile Device, see “Using Your Card Through a

Mobile Device” for more details.

Linking accounts for Card access and designating a primary

account

Linking lets you add accounts you own (e.g., checking or

savings accounts) to a debit or ATM Card, giving you access

to make transactions on multiple accounts with one Card at

WellsFargo ATMs. At most Wells Fargo ATMs, you have access

to Accounts linked to your Card.

If you link only one account of a single type (e.g., checking

or savings accounts) to the Card, that linked account is

automatically designated as the “primary” linked account for

purposes of electronic fund transfer services. A debit Card

must have at least one checking account linked, designated

as primary checking. The money for purchases and payments

made with your Card is deducted from the primary linked

account. The money for purchases made with your ATM Card

is deducted from the primary checking account; if no checking

account is linked, it is deducted from the primary savings

account. Cash withdrawals using a Card at a participating non-

WellsFargo ATM may be deducted from the primary checking

or savings account. Note: Not all ATM operators support

display of more than one type of account.

If you link more than one account of a single type to the

Card, you may designate a primary linked account and other

accounts.

If you do not designate a primary linked account, the

rst account of that type linked to your Card is considered the

primary linked account. If a primary linked account is closed

or delinked for any reason, we will generally designate a linked

secondary account of the same account type (if applicable) as the

new primary account. If the only other linked account is a savings

account and there are no other eligible checking accounts to be

linked as primary checking, your debit Card will be closed and you

can request an ATM Card. You may link a new primary account

of a dierent type (consumer, business, individual brokerage,

or commercial brokerage), than the previous primary linked

account. Depending on the new primary linked account, you may

be issued a new card type. We will determine the number and

type of accounts you can link to your Card.

Using a Card to access linked credit card and line of credit

accounts at ATMs

If you link your WellsFargo credit card account or eligible line of

credit account (linked credit account) to your debit/ATM Card,

you may use the Card to access the linked credit account at most

Wells Fargo ATMs.

You can use

the Card to obtain cash or transfer funds from the

linked credit account, as long as the linked credit account is in

good standing and has available credit. Cash withdrawals and

transfers of funds from your linked credit account are treated

as cash advances. Each of these transactions is subject to the

provisions of the applicable credit card account agreement or

line of credit account agreement, including daily limits and cash

advance fees.

You must notify us in case of errors or questions about your

WellsFargo credit card bill. If you think your bill is wrong or if you

need more information about a transaction on your bill, write to

us or call us at the address or telephone number listed on your

credit card account statement. However, you must write to us to

preserve your billing rights. Please consult your applicable credit

account agreement for complete information on the terms and

conditions applicable to your linked credit account, including

the rules related to cash advances from, and payments to, your

linked credit accounts.

Daily limits and funds available for using your Card

You may use

your Card subject to 1) your daily purchase limit and

daily ATM withdrawal limit, and 2) your Available Balance in your

Account. The following rules apply:

• Limits on dollar

amounts:

• Your Card’s daily purchase limit is the maximum U.S. dollar

amount of purchases (including cash back, if any) that can

be authorized each day from your primary linked Account,

less merchant fees, if any. Note: If you use your Card or Card

number to fund a digital wallet, brokerage, or other type of

account, these Account Funding Transactions (AFTs) will

count against your Card’s daily purchase limit (AFTs may also

be limited by the applicable card network).

- If your daily purchase limit is more than $99,999, you may

ask that the merchant process multiple transactions to

complete a purchase above this amount.

• Your Card’s daily ATM withdrawal limit is the maximum

amount of cash you can withdraw each day from any

combination of accessible Accounts using your Card, less any

fees charged by the non-Wells Fargo ATM operator or third

party, if applicable.

4

-

• When you use a Wells Fargo ATM in Assisted-Service mode,

your Card’s daily ATM withdrawal limit may not apply.

• The limits for your Card: We provide you your daily ATM

withdrawal and purchase limits when you receive your Card. You

can conrm your Card’s daily limits by signing on to WellsFargo

Online or the Wells Fargo Mobile® app, or calling us at the

number listed in the “Contact Us” section. Note: For security

reasons there may be additional limits on the amount, number,

or type of transactions you can make using your Card, including

the geographic location of the ATM or merchant.

• Changes to your Card limits: We may, without telling you,

increase your Card’s daily purchase or ATM withdrawal

limit based on Account history, activity, and other factors.

If we decrease the limits of your Card, we will notify you in

accordance with applicable law.

• Available Balance: Your “Available Balance” is the most current

record we have about funds that are available for withdrawal

from Accounts accessible using your Card. You may use your

Card as often as you want each day as long you stay within

your daily ATM withdrawal limit and daily purchase limit, and

you have sucient Available Balance in any of your Accounts

used

for withdrawal. If using your Card to perform an ATM

transaction or purchase would create an Overdraft on the

Account, we may take actions described in the section of this

brochure titled “Creating an Overdraft Using Your Card.”

Note: Your current Available Balance may not yet reect all of

the transactions you have made, including but not limited to a

Card purchase that the merchant has not yet transmitted to

us, or a check you wrote that has not been cashed by the payee.

For more information about how your Available Balance is

calculated, please refer to your Deposit Account Agreement.

• Authorizations: When we approve a transaction or purchase,

we call that an “authorization.” We may limit the number of

authorizations we allow during a period of time (e.g., if we

notice out-of-pattern use of your Card, or suspected fraudulent

or unlawful activity). For security reasons, we cannot explain

the details of the authorization system. If we do not authorize

the payment, we may notify the person who attempted the

payment that has been refused. We will not be responsible for

failing to give an authorization.

•Partia

l authorization for Card transactions: If a Card purchase

amount exceeds the current Available Balance in the primary

linked

checking or savings Account when you are making a

purchase, you may be able to use your Available Balance to

pay for a portion of the total purchase. The transaction will be

subject to a partial authorization daily purchase limit set by us

and your Card’s daily dollar limit. We will rst try to approve the

full amount of the purchase with the available funds in your

checking account, account(s) linked for Overdraft Protection,

and, if enrolled, using Debit Card Overdraft Service. If we do

not approve the full amount of the purchase, we may approve

a portion of the purchase using the remaining available funds

in your checking account. This is called a “partial authorization.”

The remaining amount of the purchase total would need to be

covered by another form of payment, such as cash or another

card. If you are unable/unwilling to provide an additional

form of payment, the partial authorization will be reversed

by the merchant. Not all merchants are able to accept partial

authorizations or process transactions using multiple forms of

payment.

Illegal transactions and internet gambling

You must not use your Card or Account for any illegal purpose.

You must not use your Card or Account to fund any account

that is set up to facilitate internet gambling, except certain

government (or state) owned lotteries and certain government

licensed online casinos and horse/dog racing. In our discretion,

we may allow or deny transactions or authorizations from

merchants who are apparently engaged in or who are identied

as engaged in the internet gambling business.

Ending your Card use

Your Card is our property. We may cancel or suspend your Card

or Card banking access at any time without notice to you (for

example, if you fail to activate your Card). We may decide not

to issue a Card to you or replace your Card (for example, if the

Card has not been used for a prolonged period of time). You

may cancel your Card at any time by calling the number on the

back of your Card. If the Card is canceled, you must pay for any

Card transactions made before the Card is canceled, and you will

immediately destroy the Card after it is canceled.

You can monitor your Card transactions:

• Keep track of your transactions with online or mobile banking.

• Get c

ard activity alerts delivered by email, push notication,

or text. Sign-up may be required. Availability may be aected

by your mobile carrier’s coverage area. Your mobile carrier’s

message and data rates may apply.

• Review your account statements regularly to verify

transactions.

USING YOUR CARD THROUGH A MOBILE DEVICE

If you make debit Card transactions through a Mobile Device,

these Terms and Conditions apply. When you use your debit Card

with your Mobile Device for transactions:

• Avail

ability may be aected by your mobile carrier’s coverage

area, and your mobile carrier may charge you message and data

rates, or other fees.

• Some

(but not all) digital wallets require your Mobile Device to

be NFC (Near Field Communication) enabled and to have the

separate wallet app available.

• Your debit Card information is sent across wireless and

compu

ter networks.

• Information about your Mobile Device may be transmitted

to us

.

• You should secure the Mobile Device the same as you would

your cash, checks, credit cards, and other valuable information.

We encourage you to password protect or lock your Mobile

Device to help prevent an unauthorized person from using it.

• Please notify us promptly if your Mobile Device containing your

Digital Card Number is lost or stolen. See “Contact Us” section.

• When you make a purchase or payment using your Mobile

Device, the merchant may not provide an option for cashback.

• Some Wells Fargo ATMs within secure locations may require a

physical Card for entry.

• You can access WellsFargo ATMs by holding your Mobile

Device close to the Contactless Symbol.

• When you access a Wells Fargo ATM with your Mobile Device

and Card PIN, you can perform only one monetary transaction

per visit, such as a cash withdrawal or funds transfer.

• If you are accessing a Wells Fargo ATM in Assisted-Service

mode using your Mobile Device, your Card’s daily ATM

5

withdra

wal limit will apply and you will not be able to access

accounts that are not linked to your Card.

• We may automatically provide third-party digital wallet

operators with updated Digital Card Number information, such

as when your Card is replaced or re-issued.

• In certain circumstances (such as when you set up recurring

payments to a subscription service), another unique identier

may be generated from your Digital Card Number to be used

for Card transactions.

When you use your debit Card with your Mobile Device for

transactions, third parties (such as merchants, card association

networks, mobile carriers, digital wallet operators, mobile device

manufacturers, and software application providers) may 1) use

and receive your Digital Card Number and information about

your Card transactions as necessary to eect, administer, or

enforce the Card transaction, and 2) receive information about

your Mobile Device. The third-party digital wallet operator may

use this information to display it to you or for its own purposes

according to the terms, conditions, and other agreements that

the digital wallet operator may require you to accept. Please

refer to the third-party digital wallet operator’s privacy policy

and terms and conditions for more detail about how the digital

wallet

operator will use and retain your information, as well as

to review any fees that the third-party digital wallet operator

may charge. We are not responsible for a third party’s privacy

practices or level of security. If a third-party digital wallet

operator displays a history of Card transactions made through

your Mobile Device, you understand that the third-party

transaction history does not reect complete information about

your Card transactions.

If you are enrolled in Overdraft Protection and/or Debit

Card Overdraft Service, those terms will apply to debit Card

transactions made through a Mobile Device. For additional

information, please see the section titled “Creating an Overdraft

Using Your Card.”

We may, at any time, partially or fully restrict your ability to

make debit Card transactions through a Mobile Device. We may

also modify or terminate a debit Card’s eligibility to be added

to a Mobile Device, as well as our participation with any third-

party digital wallet operator. If you want to remove your Digital

Card Number from your Mobile Device, please contact us. See

“Contact

Us” section.

UNDERSTA

NDING AUTHORIZATION HOLDS FOR CARD

TRANSACT

IONS

For all Card purchase transactions, we may place a temporary

hold on some or all of the funds in the Account linked to your

Card when we obtain an authorization request. We refer to this

temporary hold as an “Authorization Hold.” The funds subject to

the Authorization Hold will be subtracted from your Available

Balance.

We generally release the Authorization Hold within 3 business

days from the time of authorization or until the transaction

is paid from your Account. Note, however that the hold can

be longer for certain types of transactions, including up to

30 business days for car rental, hotel, cash disbursements,

and international Card transactions. If the merchant does not

submit the transaction for payment within the time allowed, we

will release the Authorization Hold. This means your Available

Balance will increase until the transaction is submitted for

payment by the merchant and posted to your Account. If this

happens, we must honor the prior authorization, and we will

pay the transaction from your Account. In some situations,

the amount of the hold may dier from the actual transaction

amount since the merchant may not know the total amount you

will spend. For example, a restaurant submits the authorization

request for your meal before you add a tip.

Note: You might end up overdrawing the Account even though

the Available Balance appears to show there are sucient funds

to cover your transaction. For example, if a merchant does not

submit a one-time debit Card transaction for payment within

3 business days of authorization (or for up to 30 business

days at the bank’s discretion for certain types of debit Card

transactions), we will release the Authorization Hold on the

transaction even though we will have to honor the transaction.

The transaction will be paid from the funds in the Account when

we receive it for payment.

You should record and track all of your transactions closely to

conrm that your Available Balance accurately reects your use

of funds from your Account.

CREATING AN OVERDRAFT USING YOUR CARD

An overdra

ft occurs when you do not have enough available

money in your Account to cover a transaction but we pay it

anyway. For preauthorized recurring payments using a debit

Card, we may, at our discretion (1) authorize and pay the

transaction into overdraft, or (2) decline the transaction. We

will not authorize ATM and everyday (one-time) debit Card

transactions into overdraft unless you are enrolled in our

optional Debit Card Overdraft Service. Overdraft fees may apply

to transactions paid into overdraft. If your Account is overdrawn,

you must promptly add money to return your Account to

a positive balance. For more information about overdrafts

and associated fees, please refer to your Deposit Account

Agreement, Consumer Account Fee and Information Schedule,

or other applicable account agreement.

HANDLING PREAUTHORIZED PAYMENTS

• Right to stop payment: If you have told us in advance to

make regular (recurring) payments out of your Account, you

can stop any of these payments. Call or write to us in time

for us to receive your request 3 business days or more before

the payment is scheduled. Call us at 1-800-869-3557 (for

Private Bank Debit Card call 1-877-646-8560), or write to

us at WellsFargo, Customer Correspondence

, PO Box 6995,

Portland, OR 97228- 6995. If you call, we also may require

you to put your request in writing and get it to us within 14

days after you call. There is no fee to stop a regular (recurring)

payment using a debit Card. Note: We cannot stop payment

on a purchase transaction unless it is a preauthorized

electronic fund transfer.

• Notice of varying amounts: If the amount of these regular

(recurring) payments varies, the person you are going to pay

should tell you 10 days before each payment, when it will be

made and how much it will be. (The party you are going to

pay may allow you to choose to get this notice only when the

payment would dier by more than a certain amount from

the previous payment, or when the amount would fall outside

certain limits that you set.)

• Liability for failure to stop payment: If you order us to stop

one of these payments 3 business days or more before the

6

transfer is scheduled, and we do not do so, we will pay for

your losses or damages.

OTHER CONSIDERATIONS

• Account inquiry: You have the right to contact us to nd out

whether an electronic transfer has been credited or debited

to your Account. Call WellsFargo Bank at 1-800-869-3557, or

write to us at WellsFargo, Customer Correspondence, PO Box

6995, Portland, OR 97228-6995.

• Receipts: You can get a receipt at the time you make any

transfer to or from your Account using one of our ATMs or

when you use your Card at a merchant terminal.

CARD ON FILE WITH MERCHANTS

If you give your debit Card number to a merchant with

authorization to bill it for recurring payments, or to keep it

on le for future purchases or payments, the merchant may

receive updated Card information to process such payments,

for example, if the merchant participates in the Visa Account

Updater Service or a similar service. However, since not all

merchant

s receive updated Card information, we recommend

you notify each merchant of your new debit Card number

and/or expiration date to ensure your payments continue

uninterrupted. If you have a Card on le with a merchant and

want to cancel the relationship, be sure to cancel the relationship

with the merchant directly.

HELPING PROTECT YOUR CARD

Liability for unauthorized electronic fund transfers according

to Regulation E

Tell us AT ONCE if you believe your Card, Card number, PIN, or

other access device has been lost or stolen, or if you believe

that an electronic fund transfer has been made without your

permission using information from your check. Telephoning is

the best way of keeping your possible losses down. You could

lose all the money in your Account (plus funds in any line of

credit, savings account, or credit card linked to your account

or as part of an Overdraft Protection plan). If you tell us within

2 business days after you learn of the loss or theft of your

Card, Card number, PIN, or other access device, you can lose no

more than $50 if someone used your credentials without your

permission (however, see “Zero Liability pr

otection” below).

If you do NOT tell us within 2 business days after you learn

of the loss or theft of your Card, Card number, PIN, or other

access device, and we can prove we could have stopped

someone from using your credentials without your permission

if you had told us, you could lose up to $500 (however, see

“Zero Liability protection” section).

Also, if your Account statement shows transfers that you did

not make or authorize, including those made by your Card, PIN,

or other means, tell us at once. If you do not notify us within

60 days after the statement was mailed or was otherwise

made available to you, you will be liable for any additional

unauthorized electronic fund transfers that occurred after

the 60-day period and before you provided notice to us (if we

can prove we could have stopped those transactions had you

promptly notied us). This will apply even to unauthorized

electronic fund transfers that occur shortly before you notify

us. If a good reason (such as a long trip or hospital stay) kept

you from telling us, we will extend the time periods.

Contact in the event of an unauthorized electronic fund

transfer

If you believe your Card, Card number, or PIN, has been lost or

stolen, call us at 1-800-869-3557 (for Private Bank Debit Card

call 1-877-646-8560), or write to us at Wells Fargo, Customer

Correspondence, PO Box 6995, Portland, OR 97228-6995.

Zero Liability protection

Your Card comes with Wells Fargo’s Zero Liability protection,

which provides you with more liability protection than what

Regulation E requires for consumer Cards (see “Liability for

unauthorized electronic fund transfers according to Regulation

E” above).

With Zero Liability protection, you’ll have no liability for Card

transactions that you did not make or authorize, subject to

certain conditions and so long as those transactions occurred

before the end of the 60-day period described hereafter.

If your Account statement shows Card transactions that

you did not make or authorize, tell us at once. If you do not

notify us within 60 days after the statement was mailed or

was otherwise made available to you, you will be liable for

any additional unauthorized Card transactions that occurred

after the 60-day period and before you pr

ovided notice to us

(if we could have stopped those Card transactions had you

promptly notied us). This will apply even to unauthorized

Card transactions that occur shortly before you notify us. If

a good reason (such as a long trip or hospital stay) kept you

from telling us, we will extend the time period.

Zero Liability protection does not apply if we determine,

based on substantial evidence, that you were fraudulent or

negligent in the handling of your Card or Account, or if your

Card transaction does not meet Regulation E’s denition of an

“unauthorized electronic fund transfer,” which is an electronic

fund transfer from your Account that is initiated by a person

other than you without actual authority to initiate the transfer

and from which you receive no benet. Moreover, if you do not

notify us about an unauthorized Card transaction within 60

days from the time your statement was made available to you,

Zero Liability protection does not apply; note, however, that

this does not impact your rights under Regulation E if there is

an unauthorized electronic fund transfer from your consumer

account.

In case of errors or questions about your electronic fund

transfers

Telephone us or write to us (information listed in the “Contact

Us” section on page 7) as soon as you can, if you think your

statement or receipt is wrong or if you need more information

about a transfer listed on your statement or receipt. We

must hear from you no later than 60 days after we mailed

or otherwise made available to you the FIRST statement on

which the problem or error appeared. You should take the

following actions: 1) Tell us your name, Account number, and

the dollar amount of the suspected error, and 2) describe the

error or transfer you are unsure about, and explain as clearly

as you can why you believe it is an error or why you need more

information.

If you notify us in person or by phone, we may require that

you send your complaint or question in writing within 10

business days.

7

I

nvesti

gations

We will determine whether an error occurred within 10

business days after we hear from you and will correct any error

promptly. If we need more time, however, we may take up to

45 days to investigate your complaint or question. If we decide

to do this, we will credit your Account within 10 business days

for the amount you think is in error, so that you will have the

use of the money during the time it takes us to complete our

investigation. If we ask you to put your complaint or question

in writing and we do not receive it within 10 business days, we

may not credit your Account.

For errors involving new Accounts, purchase transactions, or

foreign-initiated transactions, we may take up to 90 days to

investigate your complaint or question. For new Accounts, we

may take up to 20 business days to credit your Account for the

amount you think is in error.

We will tell you the results within 3 business days after

completing our investigation. If we decide that there was no

error, or an error occurred that is dierent from the one you

described, we will send you a written explanation. You may ask

for copies of the documents that we used in our investigation.

Our li

ability for failure to complete an electronic fund transfer

If we do not complete a transfer to or from your Account on

time or in the correct amount, according to our agreement with

you, we will be liable for your losses or damages. However, there

are some exceptions. For instance, we will NOT be liable if:

• Through no fault of ours, you do not have enough money in

your Account to make the transfer.

• The transfer would go over the credit limit on a credit account

linked for Overdraft Protection.

• The ATM where you are making the transfer does not have

enough cash.

• The terminal or system was not working properly and you knew

about the breakdown when you started the transfer.

• Circum

stances beyond our control (such as re, ood, or power

failure) prevent the transfer, despite reasonable precautions we

have taken.

• There m

ay be other exceptions stated in your Account

documents.

Periodic statements

In general, you will get a monthly Account statement. If there are

no electronic fund transfers or payments in a particular month,

you will get the statement at least quarterly.

CARD AND ATM SAFETY TIPS

Card safety

• Always protect your Card and keep it in a safe place, just like you

would cash, credit cards, or checks. If your Card is lost or stolen,

contact us immediately.

• Avoid using numbers for your PIN that are easily identied

(such as birth date, phone number, or address). Note: Most

ATMs outside of the U.S. require a four-digit numeric PIN.

• Memorize your PIN, and do not write it down or give it to

anyone.

• Chang

e your PIN every six months. If you have forgotten your

PIN or want a new one, visit your nearest Wells Fargo location.

• Review your account statements and report fraudulent

transactions to us immediately.

• Make sure your internet transactions are secure, and log o

from a website after you make a purchase.

• Avoid providing your Card information or PIN over the phone

or internet unless to a trusted merchant in a call or transaction

that you initiated.

• Before using a merchant terminal or ATM, inspect it for

possible skimming devices or the presence of an unauthorized

attachment.

ATM safety

• Be sure no one sees you enter your PIN.

• Be aware of your surroundings, especially at night, and be

cautious when withdrawing cash. Avoid showing or counting

cash at the ATM. Put it away immediately and count it when you

are in a secure location such as your car or home.

• When using an ATM with a door that requires card access, close

the entry door completely and do not open the door to anyone

you don’

t know.

• The activity around Wells Fargo ATM facilities may be recorded

by surveillance cameras. If you notice anything suspicious do

not use the ATM, and, if you’re in the middle of a transaction,

cancel it, leave immediately and visit another ATM.

• If you must use the ATM at night, take someone with you.

• Keep safe or securely get rid of your ATM receipts.

• When using a drive-up ATM, keep your car running, doors

locked, and passenger windows up.

• Report all crimes immediately to the operator of the ATM

or local law enforcement and call 911 if you need emergency

assistance. For complaints about security at Wells Fargo

ATMs, contact us at the phone number or address listed in the

“Contact Us” section, and:

- In New York call: NY Department of Financial Services

1-877-226-5697.

- In New Jersey call: NJ Department of Banking 609-292-7272.

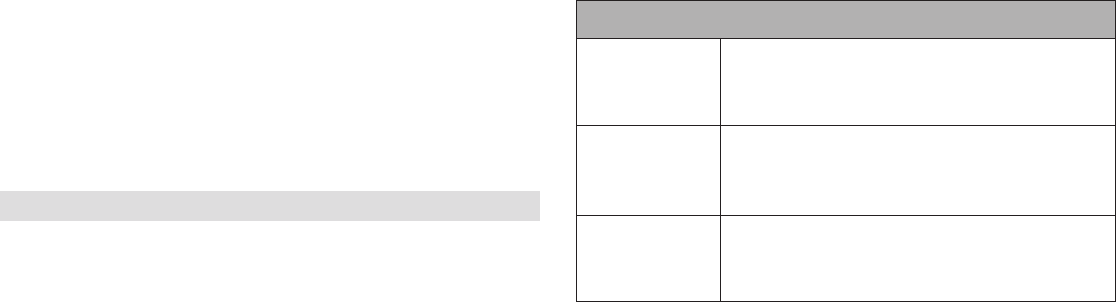

CONTACT

US

By pho

ne

1-800-TO-WELLS (1-800-869-3557)

For Private Bank Debit Card

1-877-646-8560

People

with

hearing

impairments

We accept all relay calls, including 711.

In wri

ting

WellsFargo, Customer Correspondence

PO Box 6995

Portland, OR 97228-6995

Terms a

nd Conditions eective 7/23/2024.

© 2024 WellsFargo Bank, N.A. Member FDIC.