Standardization of Customer’s Cheque Layout

Payment Systems Department 1

Payment Systems Department

State Bank of Pakistan

Annexure-I

Standardization of Customer’s

Cheque Layout

Standardization of Customer’s Cheque Layout

Payment Systems Department 2

Cheque Standardization Features

The recommended features for Cheques standardization are outlined as under:

Cheque Size:

The standard length and height of the cheque should lie between 17 to 18 cm and 7 to 8.5 cm

respectively, while the weight of cheque should be between 80-90 GSM.

The cheque font size should be between 8 to 9 points.

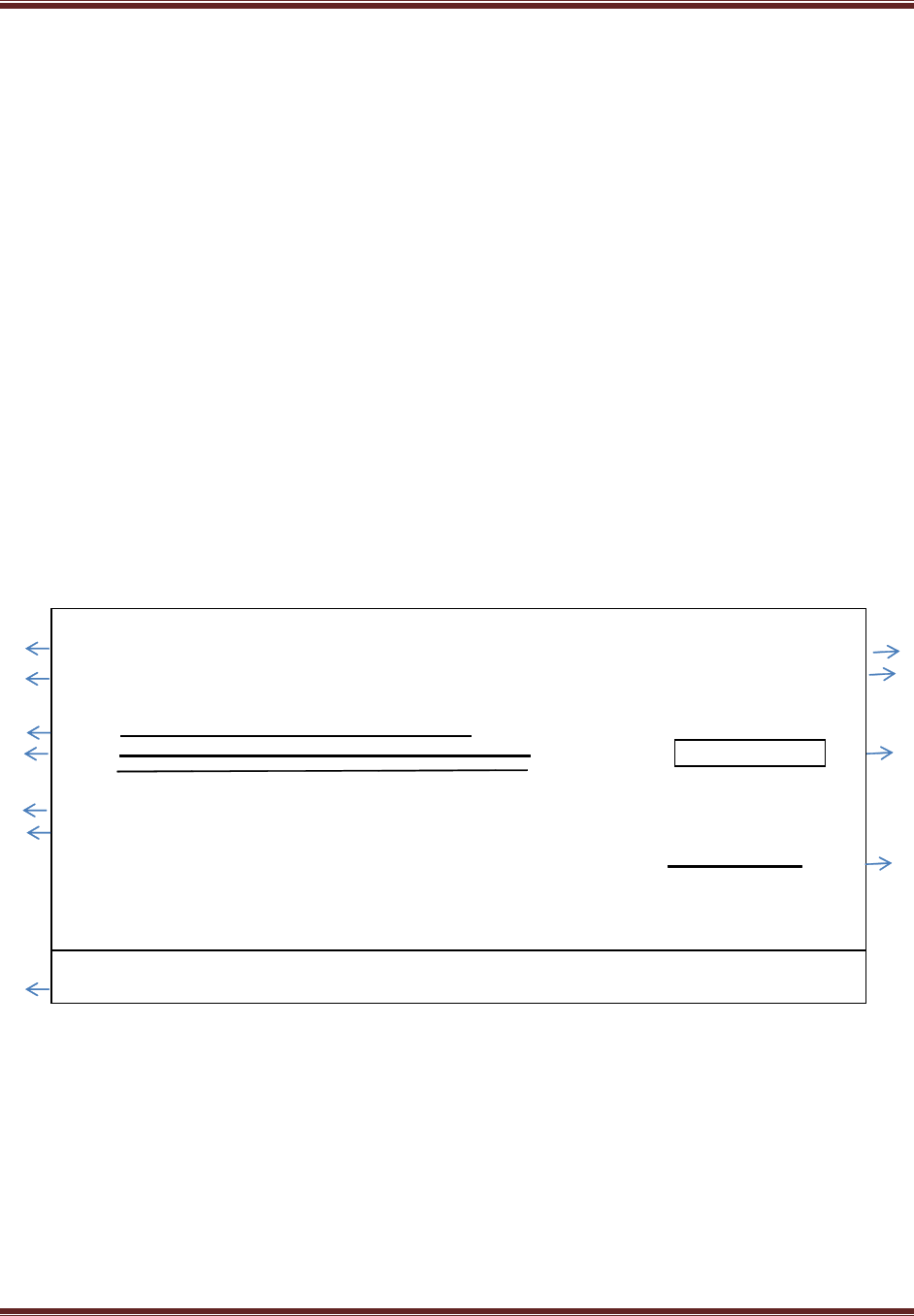

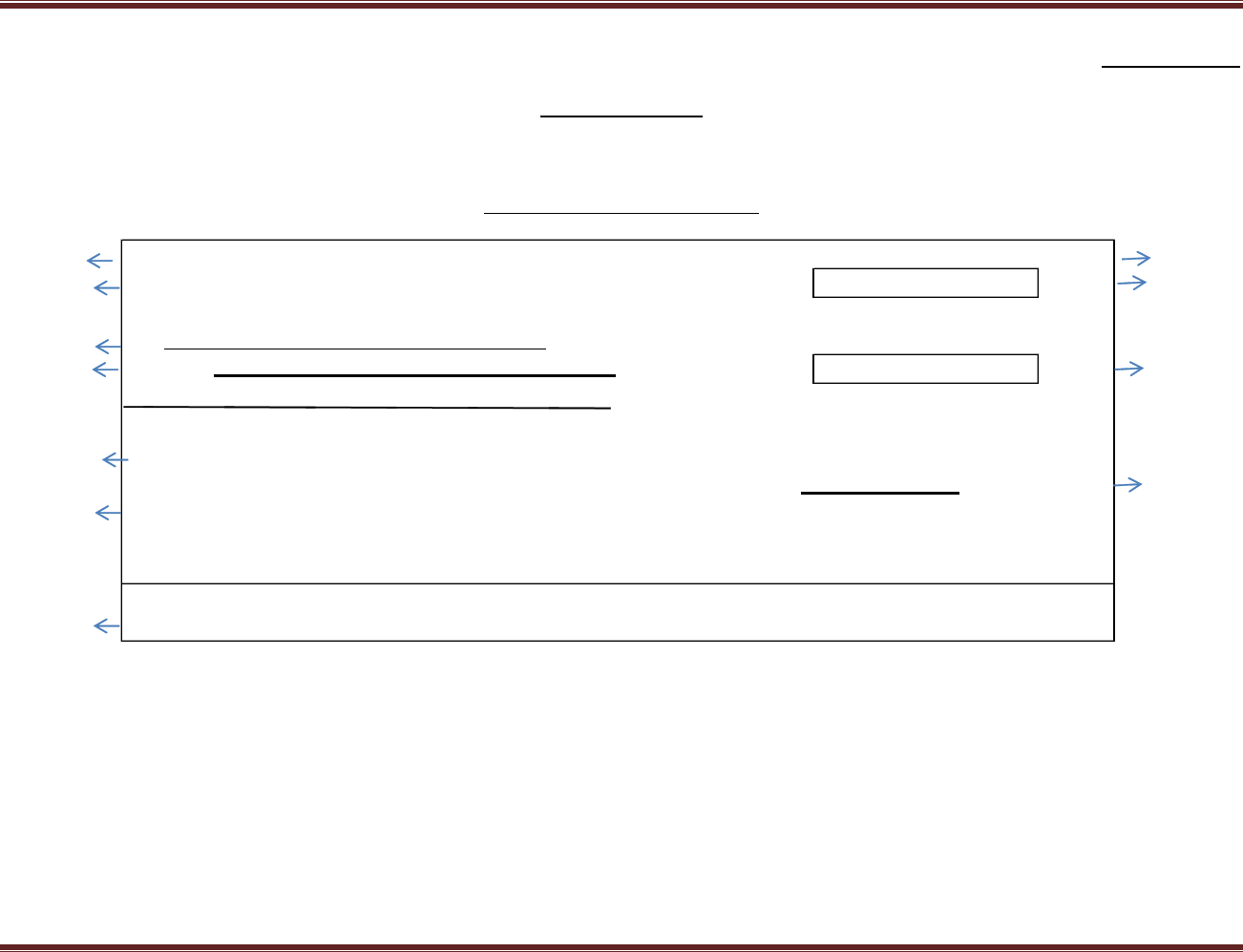

Front Layout of the Cheque:

The following data elements (described below) are designated Areas of Interest (AOI). The

rationalization of front layout of a cheque is elaborated below (the specimen drawn to actual

scale for Pak Rupee is attached at Annexure-A (I) and for Foreign currency cheque is attached at

Annexure-B (I).

(Not drawn to actual scale)

The point wise brief description of these items is as follows:

1. Logo of the Bank:

The Logo of the bank should be printed on top left of the cheque. The standard height of the

logo must lie between 0.5 to 1 cm and length from 4 to 5 cm respectively.

2. Bank Name and Address:

The Bank name is mandatory along with branch address/code and city to be written under the

name of the Bank having length from 7 to 8 cm.

Logo of the bank Cheque No 3

Bank name & address Date [D ][D ][M][M][Y ]Y[][Y][Y] 4

Rupees PKR 7

IBAN:

Payer na me

10

Si gna ture

MICR

11

Pay or bea rer

8

9

Pleaa se do not write below thi s line.

6

1

2

5

Standardization of Customer’s Cheque Layout

Payment Systems Department 3

3. Cheque Number:

The Cheque Number must be printed on the extreme upper right side of the cheque above the

date field.

4. Date:

The date field must be located on the upper right side of the cheque.

The accepted numeric representation for the date field on cheques is DDMMYYYY to be

printed in lucid background.

Any kind of slashes or other symbols are NOT permitted between elements of the date.

5. Payee’s Name:

The payee’s name should start with the phrase “Pay” and end with the phrase “or bearer” in

the designated space by horizontal marked lines.

6. Amount in Words (Legal Amount):

The amount in words may be printed or handwritten in the designated space identified by two

parallel horizontal lines.

The line shall begin with the phrase “Rupees” for domestic currency. In case of foreign

currency, the phrase starts with “For the sum of” and ends with the relevant name of foreign

currency.

Examples:

i. Rupees Three hundred thirty five thousand five hundred twenty only.

ii. For the sum of Three hundred thirty five thousand five hundred twenty US Dollars only.

7. Amount in Figures

For Pak Rupee cheque, amount in figure shall be preceded by PKR within convenience amount

scan area. Any type of alphabetic characters or any type of special characters like commas,

decimals, and slashes must not be used.

Example: PKR 335520

For foreign currency cheque, the relevant currency symbol should appear in place of PKR

preceded by the amount in figure.

Example: US$ 335520

Standardization of Customer’s Cheque Layout

Payment Systems Department 4

8. IBAN (International Bank Account Number):

It is also recommended that the Cheque leaf should carry the IBAN (24 digits) as mandated vide

PSD circular No. 2 of 2012.

9. Payer’s name:

The Payer’s name must appear on cheque below IBAN.

10. Signature Line Area:

The Signature line area should be located in the lower right area of the cheque. There can be

one or more than one required signatures. Further, the word ‘Signature’ should be mentioned

under signature line.

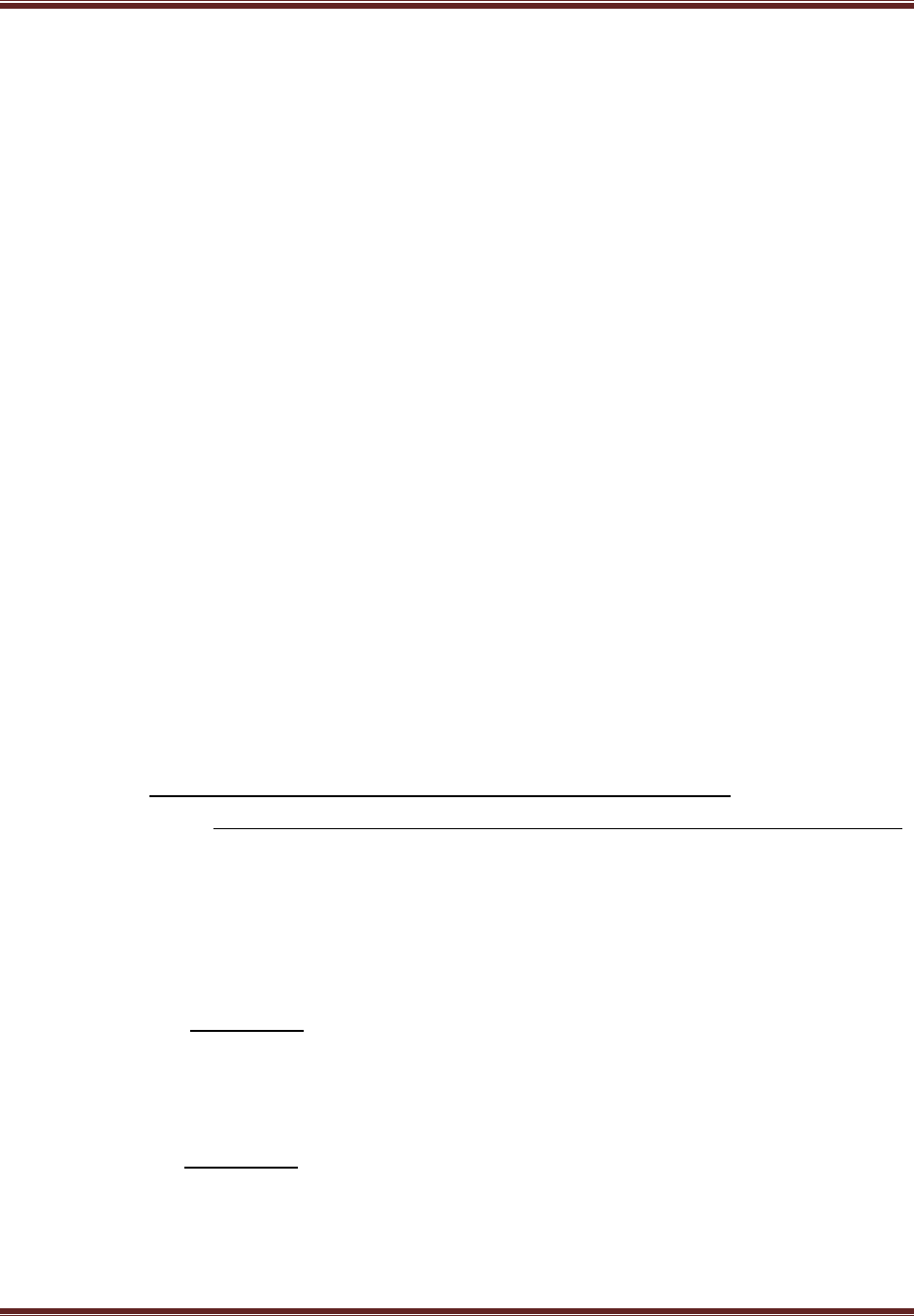

11. MICR-Encoding Area:

The Magnetic Ink Character Recognition (MICR) Line also called as MICR line must include

cheque number, bank and branch code, account number and currency code. The MICR line

should be according to E-13 B font format across left bottom side.

Example:

"30472560" 0540100':12345678912345678’:“000"

Cheque Bank & Account

Number branch Number

Specimen drawn to actual scale for Pak Rupee is attached at Annexure-A (I), printed sample of

Pak rupee at Annexure-A (II), whereas handwritten sample is attached at Annexure-A (III).

Similarly, Specimen drawn to actual scale for foreign currency cheque is attached at Annexure-B

(I), printed sample of foreign currency cheque at Annexure-B (II), whereas handwritten sample

for foreign currency cheque is attached at Annexure-B (III).

Standardization of Customer’s Cheque Layout

Payment Systems Department 5

Informational Printing:

Informational printing refers to additional printing that the cheque issuer or printer includes on

the cheque (i.e. on the front of the cheque, printing other than the MICR line).

Information printing on the front of image-able MICR-encoded document shall be of a colour

and placement which will not interfere with any Areas of Interest (AOI) on the original

document, or on an image, photocopy or microfilm representation of the document.

Conditional Statement:

There must be No conditional statement written/printed on the cheque such as “Void if over

XRs”, “Item expires on …”, “Not valid if presented for payment after (a certain date)” or “Not

valid unless presented for payment after X days following date of the issuance”, etc.

Standardization of Customer’s Cheque Layout

Payment Systems Department 6

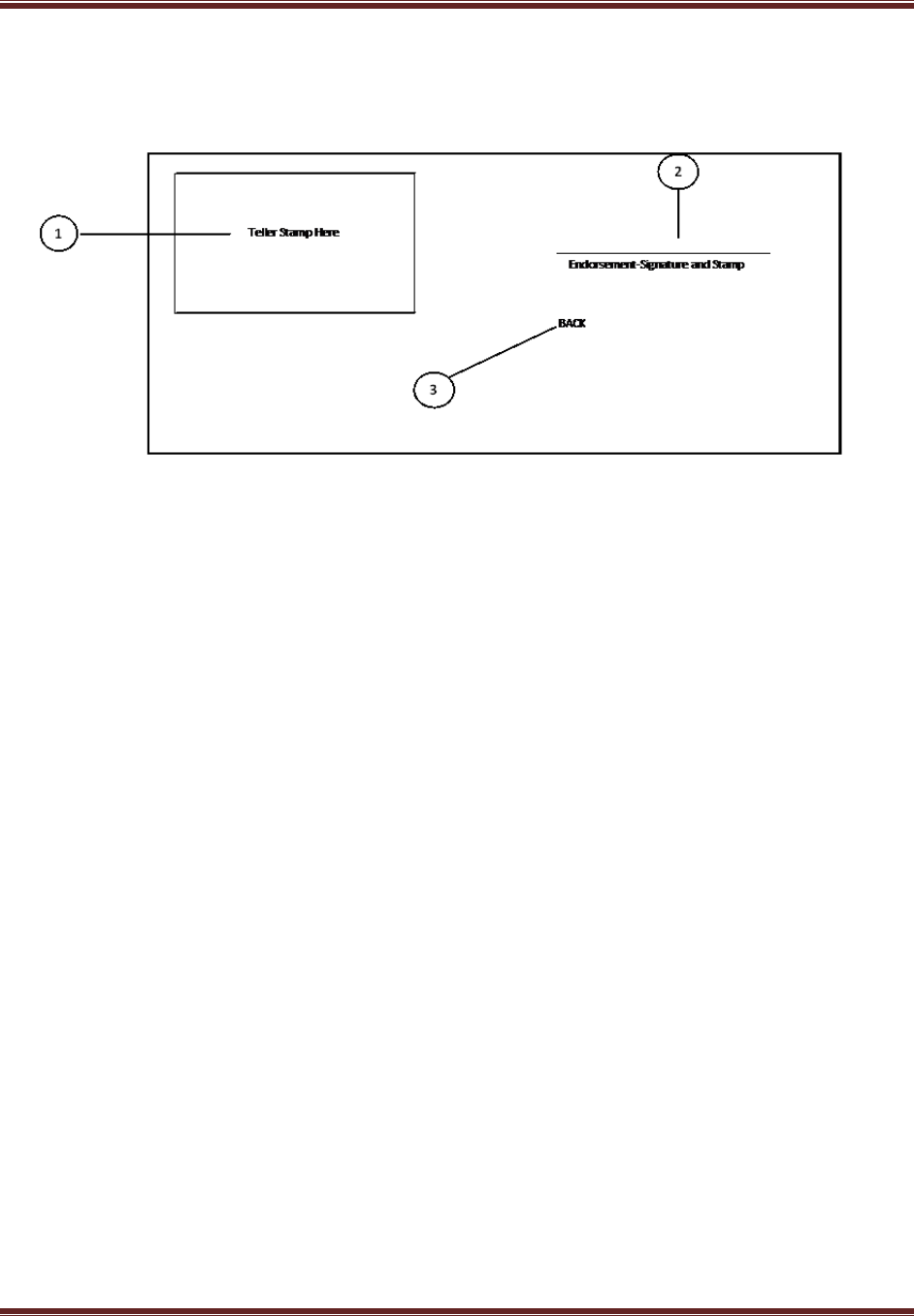

Reverse Layout of the Cheque

The basic components of Reverse side of a cheque comprise of the Teller stamp, the

endorsement area and a verification phrase.

a) Teller Stamp

The "Teller Stamp Here" box shall be located in the upper left corner on the reverse side of the

cheque. It should be located on the top-left side of the cheque. The box should contain the

phrase "Teller Stamp Here”. Further, the Teller will affix stamp on the Reverse side of a cheque.

All banks must use standardized stamp having 22mm Length and 39mm Height.

b) Endorsement area

The endorsement area includes the signature and stamp line(s) and/or addresses line(s) (where

applicable).

c) Verification phrase/Back

The verification phrase should be printed on the reverse side of the cheque.

Standardization of Customer’s Cheque Layout

Payment Systems Department 7

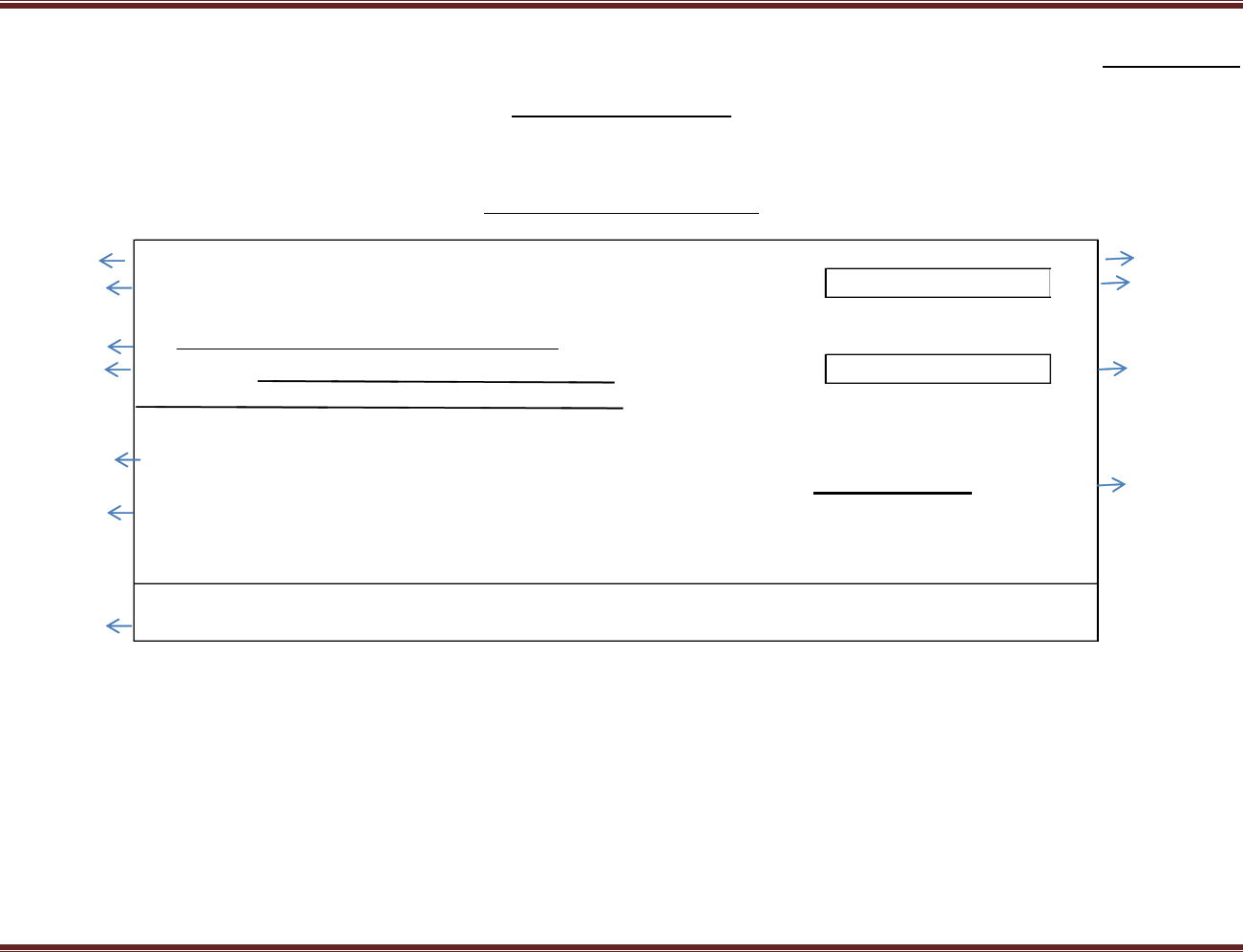

Annexure-A (I)

Pak Rupee Cheque

Specimen drawn to actual scale

Logo of the Bank

Cheque No.

3

Bank Name and Address

Date

[D ][D ][M][M][Y ][Y ][Y ][ Y ]

4

Pay

or bearer

Rupees

PKR

7

IBAN:

10

Payer name

Signature

MICR

1

2

5

11

6

9

Please do not write below this line.

8

Standardization of Customer’s Cheque Layout

Payment Systems Department 8

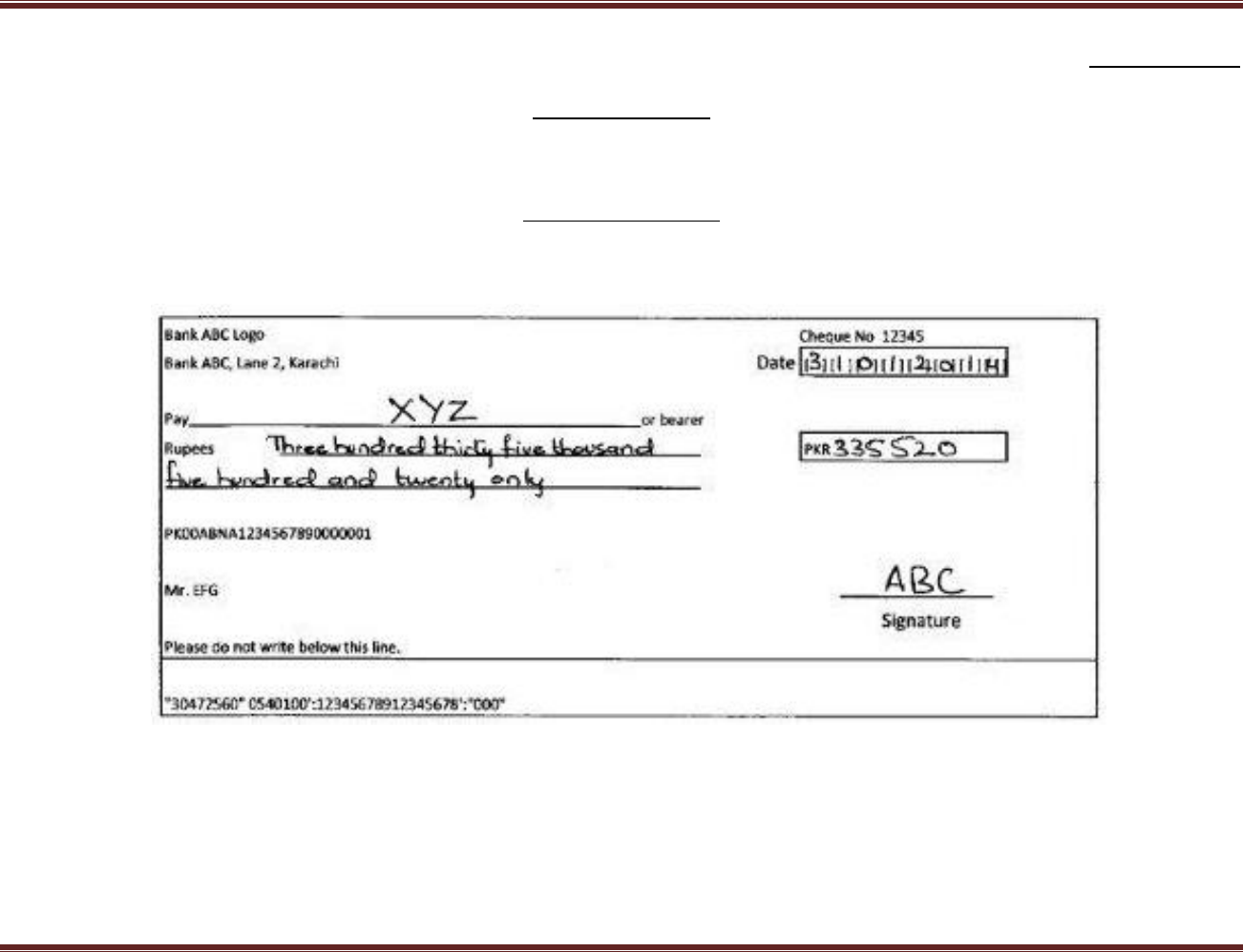

Annexure-A (II)

Pak Rupee Cheque

Printed Sample

Bank ABC Logo

Cheque No. 123456789

Bank ABC, Lane 2, Karachi

[D ][ D ][ M ][ M ][ Y ][ Y ] [ Y] [ Y]

Pay

XYZ

or bearer

PKR 335520

PK00ABNA1234567890000001

Mr. EFG

Signature

"30472560" 0540100':12345678912345678':"000"

Rupees Three hundred thirty five thousand five hundred

and twenty only

Please do not write below this line.

Date

Standardization of Customer’s Cheque Layout

Payment Systems Department 9

Annexure-A (III)

Pak Rupee Cheque

Handwritten Sample

Standardization of Customer’s Cheque Layout

Payment Systems Department 10

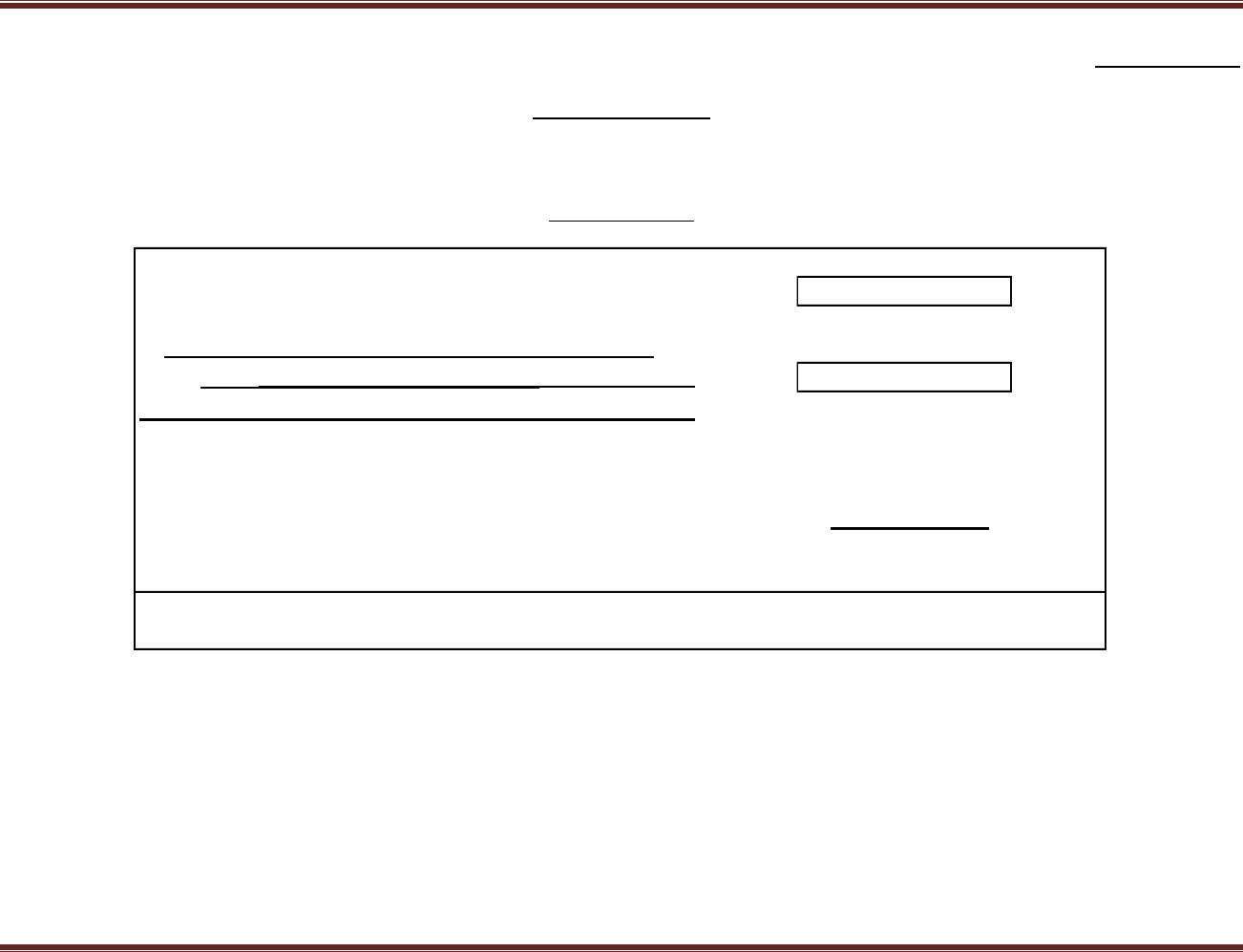

Annexure-B (I)

Foreign Currency Cheque

Specimen drawn to actual scale

Logo of the Bank

Cheque No

3

Bank Name and Address

Date

[ D ][ D ][ M ][M ][ Y ][Y ][Y ][ Y ]

4

Pay

or bearer

For the sum of

US$

7

IBAN:

10

Payer name

Signature

MICR

1

2

5

11

6

9

Please do not write below this line.

8

Standardization of Customer’s Cheque Layout

Payment Systems Department 11

Annexure-B (II)

Foreign Currency Cheque

Printed Sample

Annexure-B (III)

Bank ABC logo Cheque No 12345 3

Bank ABC l a ne 2, Karachi Da te [0 ][2 ][0][1][2 ][0][1][3] 4

Pay XYZ or bea rer

For the s um of Three hundred thirty five thousand five

US$ 335520 7

hundred and twenty US Dol lars only

PK00ABNA1234567890000001

Mr. EFG 10

Signature

"30472560" 0540100':1234567891234567':"000"

1

2

5

11

6

9

Do not write below this l ine.

8

Standardization of Customer’s Cheque Layout

Payment Systems Department 12

Foreign Currency Cheque

Glossary

Standardization of Customer’s Cheque Layout

Payment Systems Department 13

1- Convenience Amount: - The amount in figures field on a cheque that shows the amount payable. (i.e. the convenience amount

rectangle.

2- Designated Areas of Interest (AOI): - An imaginary rectangular clear area 0.64 cm (0.25") around each of the Data Elements

specified on the face of the Cheque, required to optimize image character recognition.

3- E-13 B Font Format: - The MICR E-13B font is the standard in Australia, Canada, United Kingdom, United States and other

countries. The "13" in the font's name comes from the 0.013-inch grid used to design it.

4- Field: - Heraldry the background surface or color on which a design is displayed.

5- IBAN: - The International Bank Account Number (IBAN) is an international standard for identifying bank accounts across

national borders with a minimal of risk of propagating transcription errors.

6- MICR: - Magnetic Ink character Recognition. The MICR encoding is called the MICR line.

7- Payee: - Person to whom money is being paid or is due, especially the person to whom a cheque or money order is payable

8- Payer: - The person named as responsible for the payment of a check, money order, or other financial paper when it is

redeemed.

9- Rationalization: - The actual size font & layout of cheques as prescribed by SBP.

10- Standardization: - The process to remove variations and irregularities in something and make all types or examples of it the

same or bring them into conformity with one another.

11- Teller: - An employee in a bank or savings institution who receives and pays out money.

12- Verification phrase: - The evidence that proves the genuineness of the cheque itself.