Personal Current

Accounts

Accounts Guide

Only available in NI

This guide explains the features of our current accounts and how each of these

accounts work. You should read this guide with the terms and conditions of the

account (which you will be given when you open your account or if any changes are

made at a later date) and keep it in a safe place in case you need to refer to it in the

future. If this guide and the terms and conditions of your account contradict each

other, the terms and conditions will take priority.

If you would like us to explain any issues relating to your current account, please

contact any of our branches.

Contents Page

A About our current accounts 4

1 AIB (NI) current accounts 4

2 Who can have a current account? 4

3 What form of identification do I need to provide to open an account? 5

4 How does a current account work? 6

5 Joint accounts 6

6 Alerts 6

B Online Services 6

1 Online Banking 6

2 Phoneline Banking 7

3 Clearing funds transferred through Online services 7

4 Helpline 7

C Lodgements and withdrawals 7

1 Lodgements 7

2 Withdrawals 8

3 Post Office

®

services 8

D Cheques 8

1 Writing a cheque 8

2 Out-of-date cheques 9

3 Cancelling a cheque 9

4 Unpaid cheques 9

5 Disputing a cheque paid from your account 10

6 Clearing cheques 10

E Cards 12

1 Visa debit card 12

2 Personal identification numbers (PINs) 14

3 Replacement Visa debit cards 14

4 Recurring payment transactions on a Visa debit card 14

5 Withdrawing money and buying items using your Visa debit card 14

6 Verified by Visa 15

F Standing orders and direct debits 15

1 Standing orders 15

2 Clearance of automated payments 15

3 Direct debits 16

4 Direct Debit Guarantee 16

G Statements and pre-notification 17

H Overdrafts 17

1 What is an overdraft? 17

2 How much can I borrow? 17

3 Guarantees 18

4 How much will it cost? 18

5 Repaying an overdraft 18

6 Unarranged overdrafts 18

7 Monthly cap on unarranged overdraft charges 19

8 Credit scoring and behavioural scoring 19

I Interest and fees 19

1 Credit interest – interest we pay you 19

2 How we work out credit interest 19

3 Debit interest – interest we charge you 20

4 How we work out debit interest 20

5 Fees 20

J Helping you 20

1 Safety and security 20

2 Cooling-off period 21

3 Making a complaint - our customers of AIB (NI) 21

4 Financial difficulties 22

5 Financial Services Compensation Scheme (FSCS) 22

6 Help us to help you 22

K Closing or switching your account 23

1 Closing your account 23

2 Switching your account 23

L Other information 23

1 Changes to terms and conditions 23

2 Data Protection Notice 23

3 What Happens To Your Account If You Die 27

4 General 27

Page

A About our current accounts

1 AIB (NI) current accounts

We have the following types of account.

• Junior Saver Account

• Student Account

• Student+ Account

• Graduate Account

• Classic Account

The Junior Saver Account is for children

up to 11 years old. This account pays

interest, every quarter, on the cleared

credit balance in the child’s account.

The Junior Saver Account and Student

Account do not provide overdrafts,

chequebooks, direct debits or standing

orders.

The Student Account is for young people

aged 12 to 18, and also pays interest

every quarter, on the cleared balance

in the account. If you hold a Student

Account, you will be able to apply for

a Visa debit card, but parental consent

is required for 12 to 16 year olds. As a

Junior Saver or Student Account holder

you will not pay any commission charges

on foreign currency notes transactions

completed at any of our branches.

The Student+ Account is available to

full-time higher-education students

and student nurses. We will only

issue chequebooks and Visa debit

cards depending on your financial

circumstances. These accounts are not

available as a joint account. There are

no unarranged overdraft charges with

the Student+ Account and certain other

support service fees do not apply.

With the Student+ Account, you can

apply for an interest-free overdraft of up

to £1,850 (depending on your financial

circumstances). You can also take

advantage of commission-free foreign

currency notes transactions completed

at any of our branches and a Visa debit

card which you can use to make a cash

withdrawal in pounds in the UK or a cash

withdrawal in foreign currency outside

the UK.

Our Graduate Account is available to all

students who have graduated within the

last two years. The account has similar

facilities as the standard current account.

These accounts are not available as a

joint account. There are no service or

monthly fees with the Graduate Account

and certain other support service fees do

not apply.

The Graduate Account facilities are

available for three years. These include

interest-free overdrafts of up to

£1,000 (depending on your financial

circumstances), commission-free foreign

currency notes transactions, or lodging

foreign currency cheques at any of our

branches, and access to our Online

services.

The standard Classic Account gives you

quick, convenient and easy access to

your money by providing you with a

chequebook or a Visa debit card. You can

use the card to make a cash withdrawal

in pounds in the UK or a cash withdrawal

in foreign currency outside the UK. If you

have an arranged overdraft limit with us,

you will get an interest-free portion (up

to the first £200) on which no interest

will be charged. You will also enjoy free

banking if your account is in credit. The

Classic Account does not pay credit

interest.

2 Who can have a current account?

You can have a current account if you are

18 or over depending on your financial

circumstances. So if you want a flexible

and safe way to look after your money,

our current account could be just what

you’re looking for.

4

Junior Saver Accounts are only available

to children up to 11 years old. Student

Accounts are only available to 12 to 18

year olds.

Student+ Accounts are only available to

full-time university students and student

nurses. Graduate Accounts are available

to people who have completed university

degree programmes within two years of

applying for the Graduate Account and

are able to hold this product for three

years.

3 What form of identification do I need

to provide to open an account?

When opening an account for you, the

bank will need evidence of your identity

and permanent address.

You can provide any of the following

documents to confirm your identity.

For Junior Saver Accounts, both the

parent and the child will need to provide

identification and confirmation of their

address. Other forms of identification may

be allowed for the child if there is nothing

suitable from the List A below. Please

speak to a member of staff who will be

able to advise you.

List A

• Current signed UK passport

• Current signed Irish passport

• Current UK or EEA full driving licence

or a blue disabled driver’s pass

• EEA Member State identity card

• Electoral identity card

• Current firearms or shotgun certificate

issued by a UK police force

• HM Revenue & Customs tax notices

• Photo registration card (if you are self-

employed in the construction industry)

• Government employee ID card

(police, armed services, HM Revenue

& Customs, civil servants), with a

photograph and signature

• Benefit book or original letter from the

relevant benefits agency confirming

that you are entitled to benefits or

State Pension (or both)

You can provide any of the following

documents to confirm your address.

List B

• Current UK photocard full driving

licence

• Voters roll search

• Recent utility bill (for example,

electricity or phone), utility statement

or certificate from the utilities supplier

confirming the arrangement to pay

for the services on prepayment terms

(for example if you pay for electricity

or gas by meter)

• Current Rates Collection Agency bill

• Letter from HM Revenue & Customs

• Original bank or building society

statement, mortgage statement or

credit card statement

• Benefit book or original letter

from the relevant benefits agency

confirming that you are entitled to

benefits or State Pension (or both)

• Rent book or tenancy agreement

issued by a reputable landlord

• Motor insurance certificate or

schedule

• Home insurance certificate or

schedule

• Vehicle registration document

• Original solicitor’s letter confirming

you have recently bought a house or

registered your details with the Land

Registry

If you are not able to provide any of these

documents, please speak to the member

of staff opening your account and we

will be happy to discuss other forms of

identification we can accept.

5

4 How does a current account work?

When you open a Classic or Graduate

current account, we will order you a

chequebook containing 30 cheques

(whether we order a chequebook for

you will depend on your circumstances).

You can use these to pay for goods and

services or to withdraw cash from any of

our branches. The amount you write each

cheque for will then be charged to the

balance of your account and shown on

your statement.

We will issue replacement chequebooks

automatically. If you need a replacement

chequebook before we issue it, you

should fill in the order form in your old

chequebook and take it or send it to your

branch at least 10 working days before

you need the replacement chequebook.

You can also arrange to pay regular

bills from your account by using either

a standing order or direct debit (except

if you have a Junior Saver Account or

Student Account). See section F for more

information.

You can also apply for a Visa debit card,

which you can use to withdraw cash (up

to a certain daily limit) from any cash

machine at any time of the day. If you

have a Visa debit card, you can use it to

pay for goods or services at shops and

other outlets that accept Visa Debit.

5 Joint accounts

You can open a Classic current account in

the names of more than one person (for

example, you and your husband or wife). In

this case, you will both be individually and

jointly responsible for keeping to the terms

and conditions of the account and for paying

back any money either of you owe. If you

separate or divorce, you will both continue

to be individually and jointly responsible for

any money you owe. If one of you dies, the

other will be responsible for paying back any

money either of you owe us.

When opening a joint account, you will sign

a mandate (instruction) telling us how to

authorise any withdrawals on the account

(in other words, whether only one of you

needs to give their signature or both of

you). Unless the mandate says otherwise,

in most cases any one of you can withdraw

the whole balance of the account without

the permission of the others. With a joint

account, each of you is entitled to receive

a bank statement, free of charge. You can

arrange this with us. For other conditions

relating to joint accounts, see section L,

subsection 3.

6 Alerts

An Account Alert is a text message

notification we’ll send you to help you

manage your Current Account. An Arranged

Overdraft Alert is a text message notification

we’ll send you to help you manage your

Arranged Overdraft on your Personal Current

Account. All customers with a personal

current account will automatically receive an

Account Alert. All customers with a personal

current account will automatically receive

an Account Alert and all customers with

an Arranged Overdraft on their Personal

Current Account will automatically receive an

Arranged Overdraft Alert providing we have

your up-to-date mobile telephone number.

A Balance Alert is a text message notification

we’ll send you when your account has

reached or dropped below an amount that

you set.

You can log into Online Banking to set your

Balance Alert.

B Online Services

1 Online Banking

This is our internet banking service, which

allows you to:

• check your account balance;

• check your statements;

• view pending transactions made using

your debit card;

6

• find out whether a particular cheque

you have written has been paid;

• transfer funds between accounts;

• pay bills; and

• register for eStatements.

We will give you your own registration

number and personal access code (PAC),

which you must enter every time you use the

Online Banking service. You can register for

Online and Phoneline Banking by phoning

our helpline on 028 9034 6034 or at any

of our branches. Further information and a

demo is available by visiting our website at

aibni.co.uk.

When can I use the Online services?

You can begin using our Online services

as soon as you receive your registration

number and personal access code (PAC). The

first time you use the service, you will need

authorisation from us.

Simply call 028 9034 6034 with your

registration number and PAC and they will

ask you to confirm some personal details

before giving you access to Online and

Phoneline Banking.

Once you have authorisation, you can use

the Online and Phoneline Banking services

from 7am to 3am GMT, seven days a week.

How do I use the Online Banking service?

• Enter aibni.co.uk/onlinebanking in your

browser

• Type in your registration number and

the personal access code digits you are

asked to enter.

• Follow the simple instructions to view

your bank account.

2 Phoneline Banking

You can also access your account details

using our telephone banking service.

By registering for the Online Banking service,

you will automatically be registered for our

Phoneline Banking service.

How do I use the Phoneline Banking service?

• You need a touch-tone phone to use

this service.

• Dial 0345 793 0000

†

. (Your call will be

charged at the local rate.)

• Using the keys on your phone, type

in your registration number and the

personal access code (PAC) digits you

are asked to enter.

• You will automatically be given the

latest balance on your account.

• To make an enquiry about your last

five transactions, select menu code 1

and service code 2 when asked.

• When you have finished, type in 9 to

end the call.

3 Clearing funds transferred through

Online services

You can use our Online services to transfer

funds between accounts which have been

registered for this service. If you transfer

funds between your accounts with us,

they will be available immediately for

withdrawal and will start to earn interest

(if this applies) the following banking day.

If the funds are being transferred to an

account with another bank, the funds will

normally be available no later than the next

banking day.

4 Helpline

If you have any problems using Online

services, or any questions about the

services, you can contact our helpline on

028 9034 6034

†

from 8.30am to 5pm,

Monday to Friday. We’ll be happy to help.

†

Calls may be recorded. Call charges may

vary - refer to your service provider.

C Lodgements and withdrawals

1 Lodgements

You can use your Visa debit card to lodge

money at any of our branches or at most

UK Post Offices

®

. You can also arrange

for your employer to pay your salary or

wages direct to your account.

7

2 Withdrawals

You can withdraw funds from your current

account in any of the following ways.

• By cheque.

• By handing a withdrawal slip or

your Visa debit card to the cashier

at any of our branches. If the cashier

does not know you personally, you

will need to provide some form of

identification.

If you are withdrawing local currency

from a cash machine abroad (including

the Republic of Ireland), certain fees will

apply. For more details, see our price list

for personal customers. All withdrawals

depend on whether the amount you are

trying to withdraw has cleared – see

section D, subsection 6.

Limits apply to the amounts of cash that

can be withdrawn at an AIB (NI) branch.

See aibni.co.uk/branches for more

information on these limits or ask for

more details at your local branch.

3 Post Office® services

You can use your Visa Debit Card to make

‘real time’ transactions at the Post Office

®

You can use your Card to lodge cash to

your account at the Post Office®. Limits on

the amounts of cash that you can lodge -will

apply – please see aibni.co.uk/postoffice for

more information on these limits or ask for

more details at your local branch.

All notes must be sorted by denomination

and coins must be in full bags before

presentation. Cash paid in at the Post

Office® using your Card will be credited to

your Account on the same Banking Day.

You can also withdraw up to £500 and

check your account balance at the Post

Office using your Debit card.

You can use a pre-printed lodgement

docket and an AIB (NI) Post Office

®

envelope to lodge cheques through the

Post Office

®

(Cut off times vary by outlet).

The clearing cycle for cheques begins

when amended cheques are credited to

your account, usually the next banking day.

D Cheques

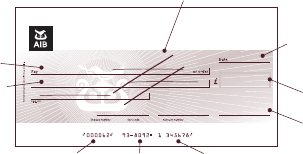

1 Writing a cheque

The diagram below shows how to write

a cheque.

Bank

Stg

93-80-92

Patrick Ryan

account payee only

Laura Mills

10-00

1/1/03

L MILLS

Ten Pounds only

Payee

Amount

in words

Cheque Number Sort Code Account Number

Signature

Amount in

numbers

Date

Crossing

Important

• Never write or sign a cheque until

you are about to issue it.

• You must not write a cheque with

a future date on it as it may not

prevent the payee from paying it into

their bank before that date. We may

allow the cheque to be lodged.

• Always make sure that the amount in

words and the figures in the box on

the right-hand side are the same.

• Always write the date on a cheque.

You should also cross it as shown in

the diagram (or by using one of the

crossings listed below).

• Always put a line through blank spaces

on a cheque and keep figures and

words close to each other to make

sure that nothing can be added later.

• If, when writing a cheque, you act

without reasonable care and this

causes you or us to suffer a loss (for

example, if you do not write the

numbers clearly and we pay out

£260 instead of £200), you may be

responsible for this.

8

The purpose of crossing a cheque is

to make it a safer way of transferring

money from one person to another and

to protect the person who writes it. If

your cheque does not have a pre-printed

crossing, you can cross the cheque by

drawing two diagonal lines (as shown in

the diagram) across it and writing in one

of the following.

• ‘& company’

• ‘& Co’

• ‘Not negotiable’

• ‘Not negotiable & co’

• ‘Account payee’ or ‘A/c payee’ (with

or without the word ‘only’)

Cheques which have any of the first

four written can be transferred by

endorsement (that is, signed on the

back by the person who is being paid).

Cheques which have ‘Account Payee’ or

‘A/c payee’ (with or without the word

‘only’) written on them cannot be cashed

and must be paid into the account of the

person the cheque is made payable to.

If you send a cheque through the post,

it will help to prevent fraud if you clearly

write the name of the person you are

paying the cheque to and put extra

information about them on the cheque.

For example:

• if you are paying a cheque to a large

organisation such as HM Revenue

& Customs, write on the cheque the

name of the account you want the

cheque paid into (for example, ‘HM

Revenue & Customs – account, L

Mills’); or

• if you are paying a cheque into a

bank or a building society account,

always write on the cheque the name

of the account holder (for example,

‘XYZ Bank – account, L Mills’).

2 Out-of-date cheques

A cheque which has not been paid

because its date is too old is known as an

’out-of-date cheque’. A cheque normally

becomes out of date after six months

from the date written on it.

For cheques processed using the “Paper

clearing system”, the bank on which

the cheque is drawn can return the

cheque to the person who wrote it for

confirmation that it should be paid.

For cheques processed using the “Image

clearing system” the bank on which the

cheques is drawn can return the cheque

unpaid due to a technicality without

recourse to person who issued it.

3 Cancelling a cheque

If you have written a cheque, you can

cancel it before it is paid. To cancel a

cheque for any reason, you should phone

your branch immediately and give them

the following details.

• Cheque number

• The date of the cheque

• The amount the cheque is for

• The name of the person it is made

out to (known as the payee)

You should confirm these details, in

writing, as soon as possible. There will be

a fee for cancelling a cheque, as set out

in our price list.

4 Unpaid cheques

We expect you to keep your account in

credit at all times, unless you have an

arranged overdraft. So, if you suspect

that your account may go overdrawn

as a result of cheques you have issued

or other debit transactions you should

check your balance and if required, you

can lodge cleared funds to your account

up to 2pm (12pm on Christmas Eve, if it

is a Banking day) to cover these items. If

this is not possible speak to your branch

about the matter.

If you write cheques which take your

account overdrawn or over your

arranged overdraft limit, we may decide

9

not to pay them. If this happens, we will

return the cheques unpaid to the payee’s

bank (the bank of the person the cheque

is made payable to) with the answer

‘refer to drawer’. You will also have to

pay a fee, in line with our price list. If we

do decide to pay the cheques (meaning

you go overdrawn or over your arranged

overdraft limit as a result), this does not

mean we will pay any cheques up to this

amount in the future. Details of these

fees, why we charge them and when we

will take the fee from your account, can

be found in our price list.

Sometimes cheques are returned ‘unpaid’

for technical reasons – for example, ‘out

of date’, ‘payment stopped’ (see section

D, subsections 2 and 3) or ‘amounts differ’

(that is, when the amounts written in

words and figures are different).

If any cheques you pay into your account

are later returned unpaid by the bank

or building society on which they are

drawn, we will take the amount from your

account. You will also have to pay a fee in

line with our price list.

For cheques processed through the

“Paper clearing system” the cheques will

be returned to you by post.

For cheques processed through the “Image

clearing system” a letter will be sent to you

to advise if the cheque can be represented

or if you will be required to obtain a new

cheque from the issuer.

5 Disputing a cheque paid from your

account

If, within a reasonable period after an

entry has been made on your statement,

you have a dispute with us about a

cheque paid from your account, we

will give you the cheque or a copy as

evidence. If there is an unreasonable

delay after you have told us about it, we

will add the amount of the cheque to

your account until we have sorted the

matter out. We will keep original cheques

paid from your account, or copies, for at

least six years.

6 Clearing cheques

When you lodge a cheque to your

account, it has to go through a process

known as the clearing cycle. We will

treat the money as ‘uncleared funds’

for a period of time, depending on the

bank the money is being drawn from.

This ‘uncleared period’ reflects the time

it takes to receive the payment from the

branch of the bank on which the cheque

is drawn.

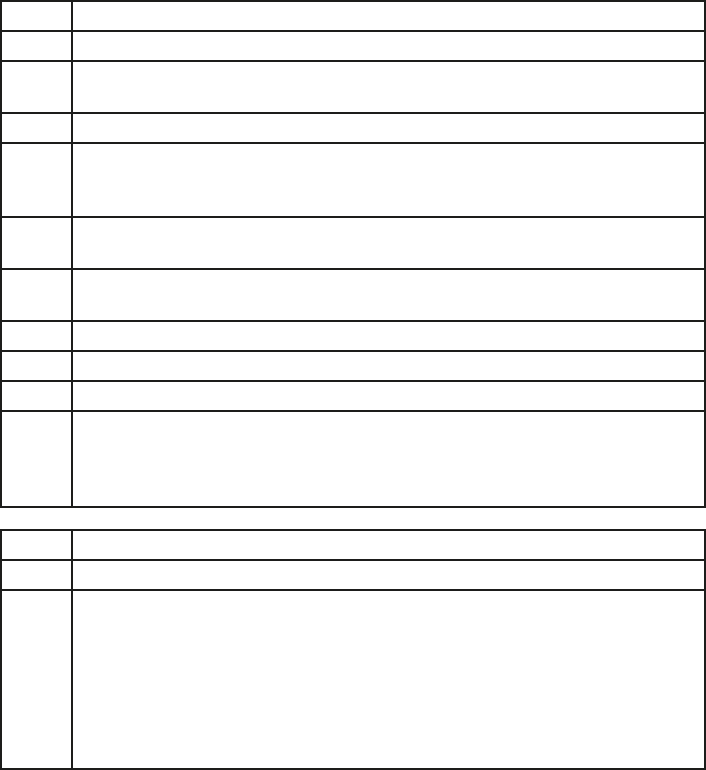

The following table shows what day

your cheque will clear for you to be able

to withdraw the money. The days refer

only to working days and do not include

weekends or bank holidays.

The clearing cycle on cheques lodged

through the Post Office

®

begins when

the cheque has been credited to your

account, usually the next banking day.

Examples - for cheques processed

through the “Paper clearing system”

AIB (NI) cheques

If you lodge an AIB (NI) cheque into

your AIB (NI) account on a Monday, the

money will normally be available for you

to withdraw on a Wednesday morning.

Once we have collected the money from

the branch named on the cheque, we will

clear the funds so we can work out what

interest you have earned, if this applies.

So, if you lodge an AIB (NI) cheque into

an AIB (NI) account that pays interest on

a Monday, it will start to earn interest (or

reduce the overdrawn balance for interest

purposes on any current account) from

that day.

Other UK bank cheques

If you lodge a cheque drawn on another

bank into an AIB (NI) account on a

10

Monday, the money will normally be

available for you to withdraw on a Friday

morning. Once we have collected the

money from the bank named on the

cheque, we will clear the funds so we can

work out what interest you have earned,

if this applies. So, if you lodge a cheque

drawn on another bank into an AIB (NI)

account that pays interest on a Monday,

you will normally start to earn interest (or

reduce the overdrawn balance for interest

purposes on any current account) on

Wednesday.

As described above, there is a risk that

the cheque could be returned unpaid

and taken from your account up to close

of business on the sixth day after the

cheque was lodged. The timescales are for

guidance purposes only and show when

we aim to make the funds available to you.

Note: These rules only apply to cheques

drawn in sterling on UK banks. Different

timelines apply for cheques drawn on

foreign banks and cheques drawn in

foreign currencies on UK banks.

11

Day Event - For cheques processed using the “Paper clearing system”

Day 0 Day the cheque is lodged into a customer’s account.

Day 1 Day the cheque is exchanged with the paying bank and processed through

their clearing system.

Day 2 Day the cheque is debited from the paying bank customer’s account.

Day that the customer gets value for the cheque (for example, the day the

funds will start earning interest OR reduce the amount of overdraft interest

charged).

Day that the paying bank makes the decision to pay the cheque or return

the cheque unpaid.

Day 3 Day that the collecting bank should receive the unpaid cheque from the

paying bank and takes the amount from the customer’s account.

Day 4 Day that the funds will be available for the customer to withdraw.

Unpaid cheque may still be taken from the customer’s account.

Day 5 Unpaid cheque may still be taken from the customer’s account.

Day 6 Last day that a cheque returned unpaid by the paying bank can be reclaimed

from a customer’s account. However, an unpaid cheque may be taken after

this date if we have the customer’s permission to take the amount from their

account, or if the customer was knowingly committing fraud.

Day Event - For cheques processed using the “Image clearing system”

Day 1 Day the cheque is lodged to the customer’s account.

Day 2 Day the funds will start earning interest or reduce the amount of overdraft

interest charged.

Funds will be available for withdrawal by the customer by no later than

23:59.

However an unpaid cheque may be debited after this date if we have the

agreement of the customer to debit their account OR the customer was a

knowing party to fraud.

Examples - for cheques processed

through the “Image clearing system”

AIB (NI) cheques

An AIB (NI) cheque lodged to an AIB

(NI) account on a Monday is normally

available for you to withdraw by no later

than 23:59 the next banking day (except

bank holidays). Once we have collected

the money from the branch stated on

the cheque it is cleared for the purpose

of calculating interest, if applicable.

Therefore an AIB (NI) cheque lodged on

a Monday to an AIB (NI) credit interest

bearing account, will normally start to

earn interest (or reduce the overdrawn

balance for interest purposes on any

current account) on Tuesday.

Other UK bank cheques:

A cheque drawn on another bank, lodged

to an AIB (NI) account on a Monday is

normally available for you to withdraw

by no later than 23:59 the next banking

day ( except bank holidays). Once we

have collected the money from the bank

stated on the cheque it is cleared for

the purpose of calculating interest, if

applicable. Therefore a cheque drawn on

another bank, lodged on a Monday to an

AIB (NI) credit interest bearing account,

will normally start to earn interest (or

reduce the overdrawn balance for

interest purposes on any current account)

by no later than 23:59 the next banking

day (except bank holidays).

The timescales are for guidance purposes

only and illustrate when we aim to make

the funds available to you.

NOTE: In exceptional circumstances a

cheque can be returned unpaid outside

of the clearing cycle outlined above.

12

E Cards

1 Visa debit card

You can apply for a Visa debit card, which

you can use to withdraw cash (up to £500 in

one day) and to make payments direct from

your current account.

You can use the Visa debit card to:

• pay for goods and services anywhere

Visa Debit is accepted – simply hand

over your card and sign the voucher or

key in your PIN number;

• pay for goods and services by post,

over the phone or on the internet –

quote your card number, its expiry

date, security code, and your name and

address;

• You can also withdraw cash over the

counter at any bank that accepts LINK

or Visa Debit throughout the world;

• make a cash withdrawal in foreign

currency outside the UK (up to £500 a

day) at any cash machine that accepts

Visa Debit (local cash machine currency

restrictions may apply).

• make a cash withdrawal in pounds

in the UK (up to £500 in one day)

including most UK Post Offices

®

.

For customers who have difficulty using a

PIN, we can offer a Chip and Signature Visa

debit card. When you buy goods in a shop,

you will not have to enter your PIN on the

terminal. Instead, the assistant will print a

receipt for you to sign and this signature

will then be compared to the signature on

the back of your card. All other transactions,

such as online and mail order, will be carried

out in the same way as the Visa debit

card, For more information or to ask for a

Chip and Signature Visa debit card, please

contact your branch.

If you have a Junior Saver Account you will

not be able to apply for a Visa debit card.

Security code

For security purposes, when you make

a purchase by phone or online you may

be asked to provide details of the CVV

‘security code’ on your card. This is the last

three digits of the number printed on the

signature panel on the back of your card.

However, you will never be asked for your

PIN.

Currency conversions

When you are using your card abroad,

some cash machines, retailers and hotels

may offer you the facility to pay in pounds

sterling rather than the local currency. If

you choose to pay in pounds sterling, it is

important to know that the retailer will apply

a local exchange rate to the transaction. This

rate is currently outside our control and we

have no way to change it. If you choose to

pay in the local currency, we will apply the

exchange rate to the transaction.

If there is a Contactless symbol located

under the Visa Debit logo (see User Guide)

on the front of your Visa Debit Card,

then your card is enabled for Contactless

payments.

Here’s how it works

› ›

Look Touch to Pay Go

› ›

Fast Simple Secure

Contactless and Mobile Payments –

The faster way to pay

If there is a Contactless symbol located under the

Visa Debit logo (see User Guide) on the front of

your Visa Debit Card, then your card is enabled

for Contactless payments.

You can pay for your purchases quickly and

securely using contactless, Android Pay

TM

. Simply

touch and pay for items that cost £30 or less with

your card/Android Pay

TM

. For items over £30 you

can pay using Android Pay

TM

depending on the

retailer.

Look for the

Contactless

symbol at the

till.

Simply hold your card or your

device against the reader.

If using a mobile device you

may be required to wake up

or unlock it.

Wait for

conrmation

and you’re

done.

How do I get started?

Card: To activate Contactless on your new

card, complete a Chip & PIN or Cash Machine

transaction and then you’re good to go.

Android Pay: Get the app on the google play

store, add your debit or personal credit card

and follow the on screen instructions. To find

out more go to aibni.co.uk/androidpay

Benets

To use Contactless on your new card, you

will need to do a Chip & PIN transaction

first in a shop or at a cash machine.

Keeping track of your spending

Visa debit card transactions are made

direct from your AIB (NI) current account.

Your bank statement will show exactly

how much you have spent and when you

have spent it. You can also track your

spending on Online Banking, Phoneline

Banking, Mobile Banking and at our cash

machines.

13

2 Personal identification numbers

(PINs)

We will provide you with your PIN and

your card separately. You can use our

cash machines to change your PIN

for your Visa debit card to a number

you prefer and can remember more

easily. The cash machine will give you

instructions on how to do this.

3 Replacement Visa debit cards

We will replace your Visa debit card if it is

lost, stolen or damaged, although we may

charge a fee for this. Our most up-to-date

fees are given in our price list. Visa debit

cards are normally valid for at least two

years and we will replace them before

their expiry date. We will not issue any

more cards on your account if you tell us

not to do so.

4 Recurring payment transactions on a

Visa debit card

You can use your Visa debit card to shop

online. You can also agree a spend limit

for your card for internet purchases.

Please contact us on (028) 9033 0099

if you would like to do this. If internet

transactions appear on your statement

and you are sure that they are not yours,

call us as soon as possible. If you have

recurring transactions (also known as

continuous payment authorities) set up

on your Visa debit card (such as internet

or magazine subscriptions) and you

wish to cancel them, you can do so by

contacting us up to the last business day

before the payment is due to leave your

account.

You should also contact the company or

service provider to advise them that you

are cancelling the recurring transaction.

Also refer to section E of our terms and

conditions brochure for information on

recurring transactions.

5 Withdrawing money and buying

items using your Visa debit card

The charges outlined in this section

will apply in addition to any other fees

as advised in the price list for Personal

customers brochure available from our

branches or on our website aibni.co.uk.

You can make cash withdrawals in

pounds in the UK or cash withdrawals in

foreign currency outside the UK. If you

withdraw money from a cash machine

not provided by AIB Group, you may be

asked to pay a handling fee (which will

go to the cash machine operator). When

you make a withdrawal, you should

be told how much these fees are and

be given the choice of cancelling the

transaction.

Using your Debit Card to make cash

withdrawals in pounds in the UK or at a

UK Post Office

®

counter

You can use your Debit Card to make

cash withdrawals in pounds in the UK.

The only fee applied by us in this instance

will be the automated withdrawal fee

mentioned above.

Using your Debit Card to withdraw

money from cash machines in Europe

and the rest of the world.

You can use your Debit Card to make

cash withdrawals in foreign currency

outside the UK from cash machines

displaying that they accept Visa Debit.

The amount will be converted at an

exchange rate set by Visa. You will have

to pay a currency conversion fee of

2.75% on the sterling amount you are

withdrawing. If you are withdrawing

a currency other than euro, you will

also have to pay a separate 1.5% cash

handling fee on the sterling amount.

14

Using your Debit Card to buy goods and

services and withdraw money over the

counter

If you use your Debit Card to buy goods

and services or to withdraw money over

the counter at any outlet that offers

this service (known as a ‘manual cash

advance’), in a foreign currency, you will

have to pay a currency conversion fee

of 2.75% on the sterling amount, which

is included in the foreign exchange rate

applied to the transaction. The amount

will be converted at an exchange rate set

by Visa.

For manual cash advances (including

pounds sterling), we will charge you a

separate 1.5% cash handling fee on the

sterling amount.

6 Verified by Visa

When shopping online with participating

retailers who take part in the Verified by

Visa scheme, we may ask you for some

extra security information to give you

an additional level of protection against

unauthorised use of your Visa debit

card. All you need to do is ensure that

you have a valid mobile phone number

registered with us because we may send

you a one-time passcode to complete the

online transaction.

If you experience difficulty using the

service or need to register your mobile

phone number, you can do this by

calling us on (028) 9033 0099. You may

not be able to proceed with your online

purchase if you do not register your

mobile number with us. You should take

all reasonable steps to keep your security

details secure at all times and you must

not let anybody else use your security

details.

F Standing orders and direct

debits

1 Standing orders

A standing order is a secure and

convenient way of making regular

payments from your current account to a

person or company. To set up a standing

order, you should contact your branch

and give them full details of the payments

you want to make, including the bank

account details of the person or company

you are paying. You can set up these

payments yourself using Online Banking.

It may take a few days to set up, amend

or cancel a standing order, so you should

give your branch the information as

soon as possible. You must have enough

money in your account to pay your

Standing Orders when they are due. You

can lodge cleared funds to your account

up to 2pm (12pm on Christmas Eve, if it

is a Banking day) to cover these items.

After a third consecutive failed payment

the Standing Order will automatically be

cancelled.

If you have a Junior Saver Account or

Student Account, you will not be able to

set up standing orders on your account.

2 Clearance of automated payments

A standing order is an instruction to

transfer money from one bank account

to another. Once the money reaches

the other account, it will be available

immediately for them to withdraw.

You can also receive money by standing

order or by having your salary or pension

paid by Bacs or Faster Payments Service

direct to your account. Once the money

reaches your account, it will be available

immediately for you to withdraw and will

start to earn interest (if this applies) the

following banking day.

15

Clearance of money transferred by

Online, Phoneline or Mobile Banking

You can use our Online or Phoneline

Banking service to transfer money

between accounts which have been

registered for these services. If you

transfer money between AIB (NI)

accounts, it will be immediately available

for withdrawal and will start to earn

interest (if this applies) the following

banking day. If you are transferring

money to an account with another bank,

it will normally be available no later than

the next banking day.

3 Direct debits

If you have regular bills to pay (such as

electricity or phone bills) but the amounts

are different each time, you can pay them

automatically by direct debit. To set up

a direct debit, you should contact the

company you want to pay. They will send

you a direct-debit mandate form, which

you will need to fill in and return.

• Setting up a direct debit from your

current account gives a company

or organisation permission to take

specific amounts from your account

on the dates the payments are due,

and amend the amounts when

necessary.

• The company or organisation you

are paying must tell you before they

make any changes to the amount you

pay, or how often you pay it.

• To cancel a direct debit, you should

write to your branch, we must

receive this notice no later than the

end of the banking day before the

date the payment is due to be made.

However, we can only recall or

cancel the payment if you have given

us your permission in writing. You

should also write to the company or

organisation you have been paying.

You must have enough money in your

account to pay your direct debits when

they are due. You can lodge cleared

funds to your account up to 2pm (12pm

on Christmas Eve, if it is a Banking day) to

cover these items. If there is not enough

money, we may stop the payment and

charge you a fee. This could make your

account overdrawn or take you over your

arranged overdraft limit (if you have one

on your account). Our charges are set out

in the account opening pack.

If you have a Junior Saver Account or

Student Account, you will not be able to

set up direct debits on your account.

4 Direct Debit Guarantee

This protects you if a direct debit you

have not authorised is taken from your

account – for example, if too much is

taken, if it is taken too early, if it is taken

after you have cancelled the direct debit,

or if you have not been given enough

notice about a change to a direct debit.

If any money is wrongly taken from your

account under a direct debit, we will

refund your account as soon as you tell

us about the payment.

• All banks and building societies that

take part in the Direct Debit Scheme

offer this guarantee.

• Your own bank or building society

monitors the scheme to make sure it

is as secure and efficient as it can be.

• If there is a change to the amounts

you pay or the dates you pay them,

the person or organisation taking the

payment will give you 10 working

days’ notice (or any notice otherwise

agreed).

• If your bank or building society

makes a mistake, you are guaranteed

a full and immediate refund of the

amount you paid from your branch.

16

• You can cancel a direct debit at

any time by writing to your bank or

building society. Please also send a

copy of your letter to the company

who you had set up the Direct Debit

to pay.

G Statements and pre-

notification

Junior Saver, Student 12 to 18, Student+

and Graduate current accounts only

We must make your statement available

to you at least every month free of

charge during any period that there has

been a payment transaction on your

Account. If you are a registered user of

Online and Mobile banking, you have

the option to view eStatements through

these services. Using Online Banking

you can choose to stop receiving your

statements in paper format. If we do not

hear from you, we will assume you are

happy to receive your statement in the

same way you receive this information

currently, for example, by way of paper

or eStatement.

Classic current accounts only

If you have accrued any debit interest or

fees during the month, we will send you

a statement and pre-notification for that

period. The pre-notification will give you

at least 14 days’ notice before we take

the fees or interest (or both) from your

account on the date shown on the pre-

notification.

If you have kept your account in credit

during the month and have no debit

interest or fees to pay, we must make

your statement available to you at least

every month free of charge during any

period that there has been a payment

transaction on your Account. If you are

a registered user of Online and Mobile

banking, you have the option to view

eStatements through these services.

Using Online Banking you can choose to

stop receiving your statements in paper

format. If we do not hear from you, we

will assume you are happy to receive

your statement

in the same way you receive this

information currently, for example, by

way of paper or eStatement.

H Overdrafts

1 What is an overdraft?

An overdraft is a flexible, short-term

borrowing facility that you can arrange

on your current account, normally for

periods of up to one year. Your local

branch can usually set the overdraft up

within 24 hours, even over the phone. As

a responsible lender, we will only lend

you money based on our assessment of

your ability to pay the amounts back. You

must be aged 18 or over.

You cannot have an overdraft if you

have a Junior Saver Account or Student

Account.

2 How much can I borrow?

Overdrafts are meant for short-term

borrowing. The amount you can borrow

(the arranged overdraft limit), and our

decision to lend money, will depend on a

number of factors, including:

• your income and commitments;

• how you have handled your financial

affairs in the past;

• information we have gathered from

credit-reference agencies and, with

your permission, other people and

companies (for example, employers

and other lenders);

• information you have supplied,

including proof of your identity and

your reasons for borrowing the money;

• credit assessment techniques

(for example, credit scoring – see

17

subsection 8 below); and

• any security you have provided (for

example a letter of guarantee, a legal

charge over a property or a charge

over deposits).

When we agree your overdraft, we will

write to you, setting out the terms and

conditions of the borrowing. Both you

and we will be bound by these terms and

conditions.

3 Guarantees

If you want us to accept a guarantee or

other security from someone that you will

pay back the amount you have borrowed,

we may ask you for your permission

to give confidential information about

your finances to the person giving the

guarantee (or other security), or to their

legal adviser. We will also:

• encourage them to get independent

legal advice to make sure that they

understand their commitment and

the effect their decision could have

(where appropriate, the documents

we ask them to sign will clearly set

out this recommendation);

• tell them that by giving the guarantee

or other security, they may become

responsible for repaying the amount

instead of, or as well as, you; and

• tell them what responsibilities they

will have.

We will not take an unlimited guarantee.

This means the letter of guarantee will

show the person, or people, who made

the guarantee what amount they are

responsible for.

4 How much will it cost?

For full details of the fees and interest that

may apply to an overdraft, see our price

list.

5 Repaying an overdraft

You are allowed to be overdrawn for the

period we agreed when we set up your

arranged overdraft limit. If you fail to meet

the conditions of your overdraft, we may

cancel it and demand that you repay any

money you owe. At the end of the period

your arranged overdraft limit applies

for, we will contact you to arrange to

review that limit. If you fail to review and

renew your limit (if appropriate), we will

charge you fees that apply to unarranged

borrowing (see subsection 6 below) for

any overdraft you use, but that has not

been arranged.

6 Unarranged overdrafts

If you have insufficient funds in your

account to cover a payment instructed

by you and you do not have an agreed

overdraft limit, or it brings you above your

agreed overdraft limit, this is known as

an unarranged overdraft. For example, if

you write cheques on your account and

there is not enough money to cover them,

or if you write cheques which put the

account above your arranged overdraft

limit, we may still pay them (leaving

your account overdrawn or above your

arranged overdraft limit). This is known as

unarranged borrowing. It is much more

convenient to arrange an overdraft with

your branch well beforehand, making sure

that the amount you agree will be enough

to meet your needs.

You can track the progress of your

balance by making sure that you fill

in your cheque stubs and allow for

all other outgoing payments (direct

debits, standing orders and so on) and

incoming payments (salaries, lodgements,

dividends and so on). There is a section

in your chequebook for you to keep a

record of this information. You can also

track your balance at any time of the

day or night if you set up Online and

Phoneline Banking or Mobile Banking.

18

There will be a cap of £90 on unarranged

overdraft charges within the monthly

charging period as follow:

7 Monthly cap on unarranged

overdraft charges

1 Each current account will set a

monthly maximum charge for:

(a) going overdrawn when you

have not arranged an overdraft;

or

(b) going over/past your arranged

overdraft limit (if you have one).

2 This cap covers any:

(a) interest and fees for going over/

past your arranged overdraft

limit;

(b) fees for each payment your bank

allows despite lack of funds; and

(c) fees for each payment your bank

refuses due to lack of funds.

Further details can be found in the Price

List for Personal Customer’s brochure

available from our branches or on our

website aibni.co.uk.

8 Credit scoring and behavioural

scoring

When you apply for credit, we may use a

credit- scoring system. The credit-scoring

system awards points for each piece of

relevant information and adds these up

to produce a score. When your score

reaches a certain level, we will generally

agree to your application. If your score

does not reach this level, we may not

agree to your application.

To review, renew or extend your existing

credit, we may use a behavioural

scoring system, sometimes known as

performance scoring.

This system examines how you have

used your account and assesses whether

it would be suitable for us to renew or

extend your credit.

I Interest and fees

1 Credit interest – interest we pay you

We pay credit interest on Junior Saver

Accounts and Student Accounts (for

young people aged 12 to 18). The

interest rates for these accounts may

change. How we make changes to our

interest rates is set out in our terms and

conditions brochure. We will also display

all our interest rates on our website at

aibni.co.uk

2 How we work out credit interest

Junior Saver and Student Accounts only

We work out credit interest each day on

the cleared balance of your account, and

pay it into your account quarterly. We do

not pay credit

interest on cheques until they have

cleared (see section D, subsection 6). If

both debit interest and credit interest

apply during the three-month period

for which we work out interest, we will

charge the ‘net interest’ (the amount left

over after taking the credit interest from

the debit interest) to your account.

All account holders who receive credit

interest

Credit interest if applicable, on all

accounts will be paid gross. If your credit

interest is more than your Personal

Savings Allowance you may still have

tax to pay. Please see www.gov.uk for

information on the Personal Savings

Allowance or speak to a tax advisor.

For more information on credit interest,

please see our price list.

19

3 Debit interest – interest we charge

you

We will charge debit interest on the

amount you are overdrawn which is in

excess of the interest-free limit and within

any arranged overdraft limit. The interest

rate that applies will vary depending on

circumstances, and will be set at a rate

above the AIB (NI) base lending rate. We

will tell you the rate that applies to your

account when you open your account.

You can also find details of your debit

interest rate on our website at aibni.co.uk,

by calling our helpline on 0345 6005 925

†

or by contacting your local branch. If our

base rate changes, we will display the

changes on notices in all our branches

and on our website at aibni.co.uk

4 How we work out debit interest

We work out debit interest each day on the

overdrawn balance of your account which is

in excess of the interest-free limit and within

any arranged overdraft limit.

5 Fees

Classic Account

We work out fees each month and send

you a pre-notification with your statement,

giving you at least 14 days’ notice of the

fees you owe us. We will charge these

fees to your account the following month.

We will clearly show you the date the fees

are due on the pre-notification we send

with your statement. For more information

on the fees that apply to these accounts,

please see our price list.

Other current accounts

Junior Saver, Student 12 to 18, Student+

and Graduate Accounts

You do not pay fees if you have one of

these accounts.

Full details of our fees can be found in

our price list which you can pick up at

any branch. We will tell you at least two

months beforehand if we plan to increase

or introduce any new fees. If we plan to

charge you any fees that are not set out in

the price list for personal customers, we will

tell you about these before we provide the

service or at any time you ask. Our fees may

change in the future.

†

Calls may be recorded. Call charges may

vary – refer to your service provider.

J Helping you

1 Safety and security

To help prevent fraud and to protect your

accounts, it is important that you take care

of your chequebook, Visa debit card, PINs

and any passwords we may issue you

with. You should keep the following advice

in mind.

• Do not allow anyone else to use your

card, PIN or other security information

(see the note below).

• We will never ask you for your PIN. If

you are not sure a caller is genuine or if

you think they are acting suspiciously,

take their details and call us.

• If you change your PIN, you should

choose your new PIN carefully.

• Always learn your PIN and other

security information and then destroy

the letter that we sent to give you this

information.

• We will provide you with your PIN.

When you receive your PIN you should

memorise it and keep it secret. You

can also change your PIN at any UK

Cash Machine displaying the LINK sign.

Do not choose a PIN that is easy for

someone else to guess (such as your

date of birth or 1234). You must never

tell anyone your PIN. You should never

write down or record your PIN on

your Card (or anything you normally

keep with or near it) in any way which

might be recognised as a PIN, or give

someone else access to a Device you

keep your details on.

• Always take reasonable steps to keep

your card safe and your PIN and other

security information secret at all times.

20

• When shopping online with

participating retailers who take part in

the Verified by Visa scheme, ensure

that you have a valid mobile phone

number registered with us because we

may send you a one-time passcode to

complete the online transaction. You

can do this by calling us on

(028) 9033 0099.

• Never give your account details or

other security information to anyone

unless you know who they are and why

they need them.

• Keep your card receipts and other

information about your account

containing personal details (for

example, statements) safe and get rid of

them carefully.

• Take care when storing or getting rid

of information about your accounts.

People who commit fraud use many

methods such as ‘bin raiding’ to get this

type of information. You should take

simple steps such as shredding printed

material.

• Be aware that your post can be

valuable information if it gets into the

wrong hands. If you fail to receive a

bank statement, card statement or any

other financial information you are

expecting, contact us.

• You will find the APACS website

www.cardwatch.org.uk a helpful guide

for practical tips on card security and

fraud prevention.

Note: By ‘other security information’, we

mean personal facts and information (in

an order which only you know) we use to

check your identity.

If your chequebook or cards are lost or

stolen or if you suspect or discover that

someone else knows your PIN, you should

report it immediately using the following

details.

• Visa debit and credit cards

and MasterCard

Phone: 028 9033 0099

• Chequebooks

Report to your local branch.

We will take immediate steps to prevent

your cards being used once you have

reported them to us. Unless we can show

that you have acted fraudulently or without

reasonable care, your liability for misusing

your card will be limited to the following.

• If someone else uses your card before

you tell us it has been lost or stolen,

or someone else knows your PIN, the

most you will have to pay is £35.

• If someone else uses your card details

without your permission and your card

has not been lost or stolen, you will not

have to pay anything.

• If your card is used before you have

received it, you will not have to pay

anything.

If you know or suspect that someone else

knows your password, PIN or PAC, you

should report it to your branch.

2 Cooling-off period

If you are not happy with your choice of

current account within 14 days of making

your first payment into it, we will help you

switch to another of our accounts or give

you all your money back with any interest it

may have earned. We will ignore any notice

period and any extra charges. Just contact

your branch who will be happy to assist you

with your request.

If you choose not to cancel, you will

continue to be responsible for keeping to

the terms and conditions of the account.

3 Making a complaint - our customers

If at any time you are dissatisfied with our

service please let a member of staff in your

branch (or service outlet) know, giving them

the opportunity to put things right as quickly

as possible. If you wish to make a complaint

you may do so in person, by telephone,

in writing and by email. Please be assured

that all complaints received will be fully

investigated.

21

You can register a complaint through our

contact centre, our branches, our website,

by phone, by email or in person at your

branch. We ask that you supply as much

information as possible to help our staff

resolve your complaint quickly. We ask that

you provide the following information:

• your name, address, Sort Code and

Account Number.

• a summary of your complaint.

• if feasible, any relevant

documentation.

We value your feedback and will try to

resolve your complaint as soon as possible.

In the event that your complaint cannot be

resolved to your satisfaction you may have

the right to refer the matter to the Financial

Ombudsman Service. You must refer your

complaint to the Financial Ombudsman

Service within six months from the date of

our final response letter. You can contact

them at:

Financial Ombudsman Service

Exchange Tower

London E14 9SR

Telephones: 0800 023 4567

+44 20 7964 1000

(for calls from outside the UK)

Email:

Website: www.financial-ombudsman.org.uk

4 Financial difficulties

If you have financial difficulties, we will

be sympathetic when we consider your

circumstances. If you feel that you are

getting into financial difficulties, we

recommend that you talk to us at as

early a stage as possible. The sooner

you discuss the problem with us, the

sooner we will be able to help you find a

solution.

We will work with you to help develop

a plan to deal with your financial

difficulties, and we will tell you in writing

what we have agreed. We will also

consult debt counselling organisations

such as Citizens Advice if you give us

permission to do this.

5 Financial Services Compensation

Scheme (FSCS)

Important information about

compensation arrangements

In the event that AIB Group (UK) p.l.c. is

unable to meet its financial obligations,

your eligible deposits are protected up

to a total of £85,000 by the Financial

Services Compensation Scheme, the

UK’s deposit protection scheme. This

limit is applied to the total of any eligible

deposits you have with AIB (NI) and Allied

Irish Bank (GB) and Allied Irish Bank (GB)

Savings Direct in Great Britain, each a

trading name of AIB Group (UK) p.l.c. In

the case of joint accounts, each account

holder is protected up to this limit.

Any total deposits you hold above

£85,000 between these trading names

are unlikely to be covered.

For further information about the scheme

(including the amounts covered and

eligibility to claim), please ask at your

local branch or refer to the FSCS website

www.fscs.org.uk

6 Help us to help you

It will help us to provide you with a high

standard of service if you make sure you

let us know as soon as possible if you

change your:

• name;

• address;

• phone number; or

• e-mail address.

22

K Closing or switching your

account

1 Closing your account

You can close your account at any time

by giving us reasonable notice. We will

not close your account without giving

you at least two months’ notice, unless

there are exceptional circumstances (such

as we suspect that you have committed

fraud).

If you decide to transfer your account

to another bank or building society, we

will give that company information about

your standing orders and direct debits

within three working days from when we

receive your letter asking us to close the

account, so that the transfer goes ahead

as efficiently as possible.

2 Switching your account

If you want to move your current account

to another bank or building society, we

can explain how the switching process

works. Ask a member of staff for more

details.

L Other information

1 Changes to terms and conditions

When you become a customer, we will

tell you how we will let you know about

changes to our terms and conditions. If

the change is to your disadvantage, we

will tell you about it at least two months

before we make the change. During the

notice period you can, without giving us

notice, switch your account or close it

without having to pay any extra charges

or interest for doing this.

If there is a change to the Terms and

Conditions we will give you either a

copy of the full set of new Terms and

Conditions or we may provide a summary

of the changes.

2 Data Protection Notice - AIB Group

(UK) plc

Effective 1 April 2021

We respect your trust in us to use, store

and share your information. In this notice,

we explain how we collect personal

information about you, how we use it and

how you can interact with us about it.

We try to keep this notice as simple as

possible but if you are unfamiliar with

our terms, or want more detail on any

of the information here, please see our

website’s Frequently Asked Questions

section or our contact details at

aibni.co.uk/data-protection or

www.aibgb.co.uk/Data-protection.

You can also ask for more details at

your local branch.

1. Who we are

In this notice, ‘we’, ‘us’ and ‘our’ refers to

AIB Group (UK) p.l.c. which includes

AIB (NI), Allied Irish Bank (GB) and

Savings Direct, and AIB Group which

refers to Allied Irish Banks, p.l.c., its

subsidiaries, affiliates and their respective

parent and subsidiary companies. For

more information about our group of

companies, please visit

www.aibgroup.com.

We share your information within AIB

Group to help us provide our services,

comply with regulatory and legal

requirements, and improve our products.

2. Data Protection Officer

Our Data Protection Officer oversees

how we collect, use, share and protect

your information to ensure your rights

are fulfilled. You can contact our Data

Protection Officer at [email protected] or

by writing to them at: Data Protection

Officer, AIB Group (UK) p.l.c., AIB, 92 Ann

Street, Belfast, BT1 3HH.

3. How we collect information about you

We collect personal information from

you, for example when you open an

account; make a deposit; apply for

products and services; use your credit or

23

debit card; complete transactions; or look

for advice. We also collect information

through our website, apps, social media,

discussion forums, market research and

CCTV footage. We will sometimes record

phone conversations and we will always

let you know when we do this.

We may collect information to identify

you through voice, facial or fingerprint

(biometric data) recognition technology.

We always ask for your consent to do

this.

Our websites use ‘cookie’ technology.

A cookie is a little piece of text that our

server places on your device when you

visit any of our websites or apps. They

help us make the sites work better for

you.

When you apply to us for products and

services, and during the time you use

these, we carry out information searches

and verify your identity. We do this

by sending and receiving information

about you to and from third parties

including credit reference agencies and

fraud prevention agencies. We and

these agencies may keep records of our

searches whether or not the product or

service goes ahead.

4. How we keep your information safe

We protect your information with security

measures under the laws that apply and

we meet international standards. We

keep our computers, files and buildings

secure.

When you contact us to ask about your

information, we may ask you to identify

yourself. This is to help protect your

information

5. How long we keep your information

To meet our legal and regulatory

obligations, we hold your information

while you are a customer and for a

period of time after that. We do not hold

it for longer than necessary.

6. Meeting our legal and regulatory

obligations

To use your information lawfully, we rely

on one or more of the following legal

bases:

• performance of a contract;

• legal obligation;

• protecting the vital interests of you or

others;

• public interest;

• our legitimate interests; and

• your consent.

To meet our regulatory and legal

obligations, we collect some of your

personal information, verify it, keep it

up to date through regular checks, and

delete it once we no longer have to keep

it. We may also gather information about

you from third parties to help us meet

our obligations. If you do not provide

the information we need, or help us

keep it up to date, we may not be able

to provide you with our products and

services.

7. Consent

Sometimes we need your consent to use

your personal information. With direct

marketing for example, we need your

consent to make you aware of products

and services which may be of interest

to you. We may do this by phone, post,

email, text or through other digital media.

You can decide how much direct

marketing you want to accept when you

apply for new products and services. If

we ever contact you to get your feedback

on ways to improve our products and

services, you have the choice to opt out.

When we use sensitive personal

information about you, such as medical or

biometric data, we ask for your consent.

Before you give your consent, we tell you

what information we collect and what we

use it for. You can remove your consent

at any time by contacting us.

8. How we use your information

We use information about you to:

• provide relevant products and

services;

24

• identify ways we can improve our

products and services;

• maintain and monitor your products

and services;

• protect both our interests;

• meet our legal and regulatory

obligations; and

• decide and recommend how our

products and services might be

suitable for you.

To provide our products and services

under the terms and conditions we agree

between us, we need to collect and use

personal information about you. If you do

not provide this personal information, we

may not be able to provide you with our

products and services.

We analyse the information that we

collect on you through your use of our

products and services and on our social

media, apps and websites. This helps us

understand your financial behaviour, how

we interact with you and our position in

a market place. Examples of how we use

this information includes helping protect

you and others from financial crime,

offering you products and services and

personalising your experience.

We may report trends we see to third

parties. These trend reports may include

information about activity on devices, for

example mobile phones, ATMs and

self-service kiosks, or card spend in

particular regions or industries. When

we prepare these reports, we group

customers’ information and remove any

names. We do not share information in

these reports that can identify you as a

customer, such as your name, or account

details.

We sometimes use technology to help

us make decisions automatically. For

example, when you apply for a loan

online. Before we make a decision, we

automatically score the information you

give us, any information we already hold

about you, and any information we may

get from other sources.

9. Your information and third parties

Sometimes we share your information

with third parties.

For example to:

• provide products, services and